Don’t Let Your Investments Dominate the Planning Conversation

I frequently try to hammer home the point that market timing and stock selection don’t work over the long-term. See past blog posts here, here, and here.

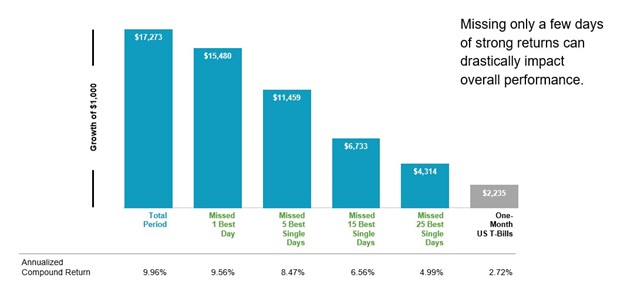

The majority of positive market returns come in short bursts…

Figure 1: Performance of the S&P 500 Index from 1990-2019

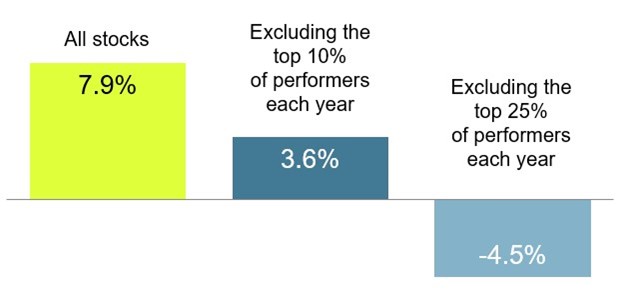

and in a small number of stocks…

Figure 2: Global Stock Returns from 1994-2019

The appeal of getting it right is that you can hit it very big. Unfortunately, the odds are against you.

My intention is that this should lead you to a sense of empowerment (hooray!—less time spent worrying about which stock to buy and when to sell), but I have learned over the years that it is sometimes taken as disappointing. After all, you’re likely a driven, successful person in your everyday life where hard work and effort tend to pay off in the long-run. Then here I come to tell you that hard work and effort when applied to “beating the market” won’t get you anywhere (and, in fact, will probably be counterproductive). I fear this sometimes comes off as “you can’t win, so don’t bother trying”, but this is not the case. The point is that by following a disciplined strategy and keeping investment costs low, you’re already a winner.

You start as a “winner”

I had several classes in college (way, way back in time) where the professor would start everyone off with an “A” at the beginning of the semester. The only way to lose that grade was to screw up. The same thing is basically true with the market—you’ll be a “winner” as long as you don’t get distracted and screw it up.

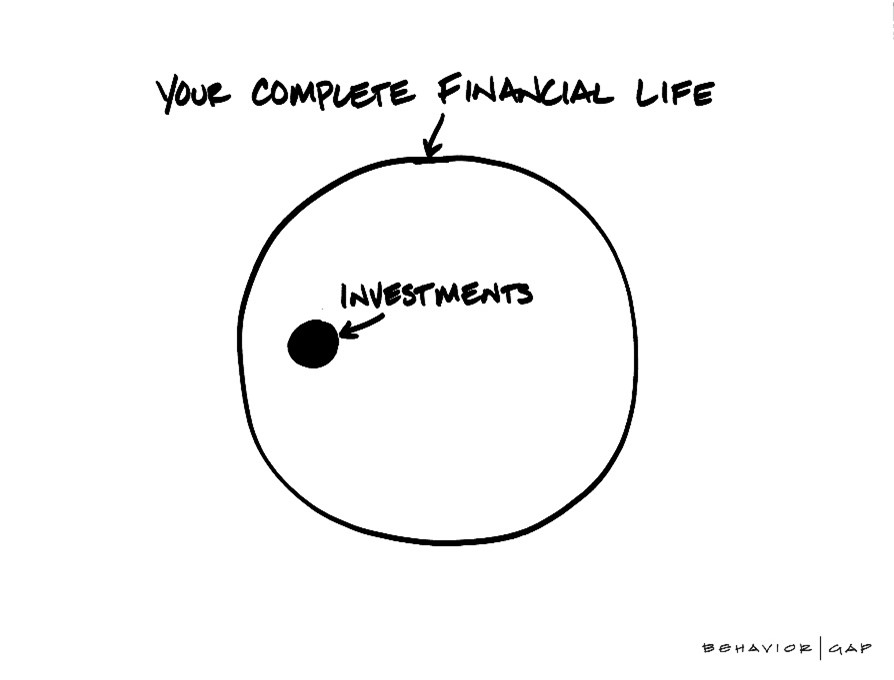

I consistently emphasize the academic approach to investing to show that it’s easier to succeed in the market than our industry would have you believe, but more importantly because I want to free you from a narrow focus on one specific part of your overall plan.

A fellow advisor told me a story about a couple who had built a sizable net worth and were happily retired. They were able to live at the standard of living they desired and only needed to have a small portion of their overall portfolio invested in the market to do so. They had kids that they wanted to leave some assets too, but were very clear that they didn’t want to leave too much. Basically, they were set. However, they were still devoting a ton of their energy to “winning” in the market (i.e. not following an evidence-based approach) and when times were bad this caused them visible stress. The advisor finally sat them down one day for a serious conversation. For all the energy they were devoting to their portfolio, there were two possible outcomes:

- Get lucky and hit it big in the market—this would ultimately lead to a larger inheritance which it was clear they didn’t want,

- Get unlucky and lose in the market—this could lead to potentially putting their standard of living at risk which it was clear they didn’t want.

It’s not about the investments.

The idea of beating the market was such a focus that they lost sight of the big picture where they had already “won”. Fortunately, the conversation stuck for this couple and they were able to start focusing their energy on more important pieces of their planning—where do we want to travel?, how can we best make an impact with the money we will leave?, etc.

For all of us, the risks of focusing on our portfolio and neglecting the big picture can compound over time. There are countless examples of those who got lucky and did “beat the market”, only to realize they were still falling short of their goals. They never took the time to think about exactly what they wanted in life and how they would get there.

Ultimately, we need to change the traditional definition of winning in the context of finance. Victory should no longer be defined as good quarterly returns, but rather by successfully living your life the way you intend.