The Last Four Months Have Enforced What We Know About Disciplined Investing

Ever since the COVID-19 crisis manifested itself in the U.S., one of the go-to coping mechanisms for people is to joke about how time has no meaning anymore. I’ve been intentionally keeping a University of Arizona basketball ticket on my desk from a game my wife and I attended with another 12,000 or so people that’s dated March 5. No masks, only 300 confirmed cases in the U.S., “social distancing” was just beginning to enter the lexicon, and it still seemed a bit odd to be hoarding toilet paper and bottled water (which actually still seems a bit odd to me). That was all less than 120 days ago. That ticket is my reminder of how quickly the world has changed even if it does feel like it’s been a decade.

Of course, stock markets have been a large part of that perception for some of us as they plunged deeply and recovered strongly all in the matter of several weeks—if you hadn’t looked at your accounts this year, you may wonder what the big deal is! Even though this is a blip in time from the historical perspective, the last several months have confirmed a lot of the lessons we’ve learned over and over again throughout history. It’s worth revisiting them both as a post-mortem and in setting our expectations going forward.

Predicting Short-Term Market Movements Is Fruitless

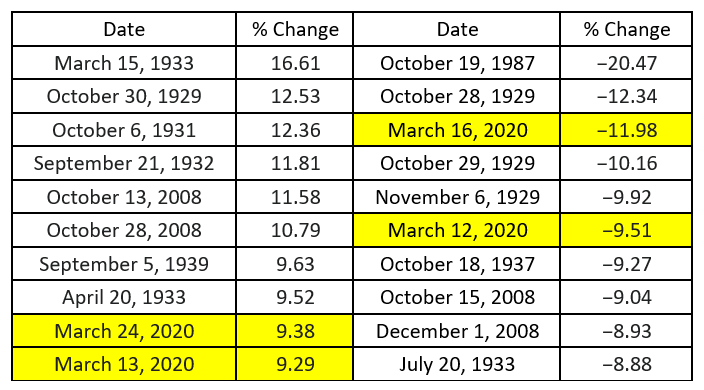

I once had a client remark, “Markets sure seem like a casino sometimes”. I replied that, yes, they essentially are when looked at on a day-to-day basis, and we’ve been reminded of that multiple times over the last 120 days. In fact, four of the largest one day moves in the history of the S&P 500 have come since March.

For context, the news was basically the same on March 12 that it was on March 13 and yet we saw completely different results. It was sometimes tempting in the moment to think that a negative day was going to be followed by a positive day and vice versa, but that’s equivalent to thinking that the next spin of the Roulette wheel had to be red since it was black on the last one. It was no more likely that a large negative day would be followed by a positive day than another negative day—in other words, it’s random.

The Market Is Not The Economy

Here’s a smattering of economic news since March 23, which was the current market low throughout the COVID crisis:

- GDP falls 53% in second quarter

- Unemployment rate surges above 14%

- Hospitals are laying off thousands of employees

- The Fed felt it necessary to buy individual corporate bonds

- The Fed slashed interest rates to zero

- US consumer prices dropped for three months in a row

- The US officially entered a recession in February

Sounds great! So what has the market done since then? Of course, the S&P 500 is up over 35%! It’s something we’ve discussed before, but market prices are based on information and investor expectations. This is why good news can make markets go down and why bad news can make markets go up. My favorite example of this is when JP Morgan’s stock price rose significantly on news reports that they would pay a record breaking fine. Investors had expected a much worse punishment, and thus, bad news was actually good for the stock price. (Why is this my favorite example? Because I never miss an opportunity to point out Wall Street’s failures, of course).

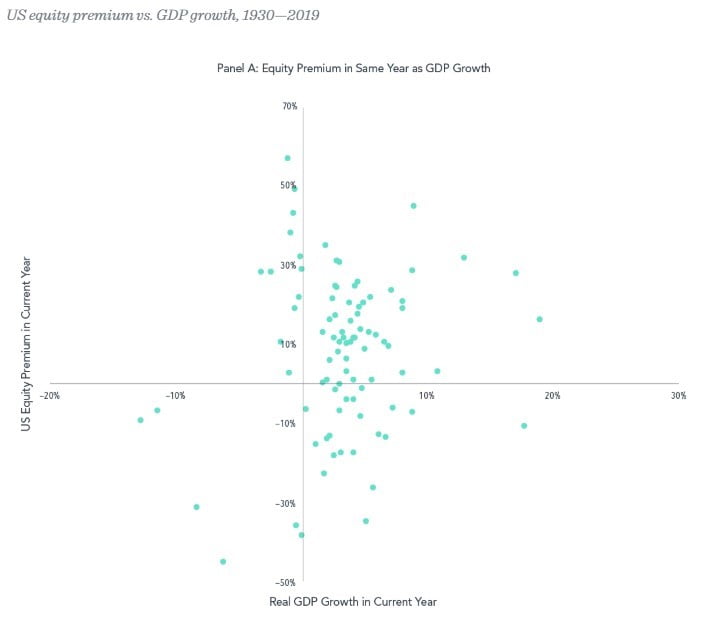

Below is a plot of stock market returns (equity premium) vs. GDP growth:

Though it may be hard to believe, there is hardly a relationship. Markets are forward-looking and prices move much more based on what may happen as opposed to what is currently happening.

Maintain A Disciplined Rebalancing Strategy

Given the historical level of volatility and the seeming disconnect between the news and markets, the importance of rebalancing is another lesson we’re being taught again.

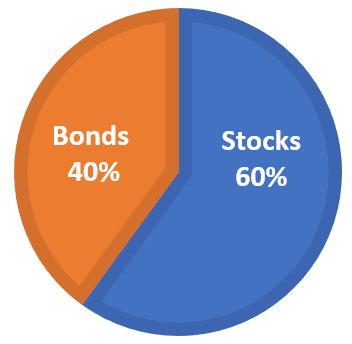

As a quick refresher, rebalancing is the term used for keeping your portfolio in line with your long-term allocation. Let’s say you had a simple portfolio that was 60% in stocks and 40% in bonds:

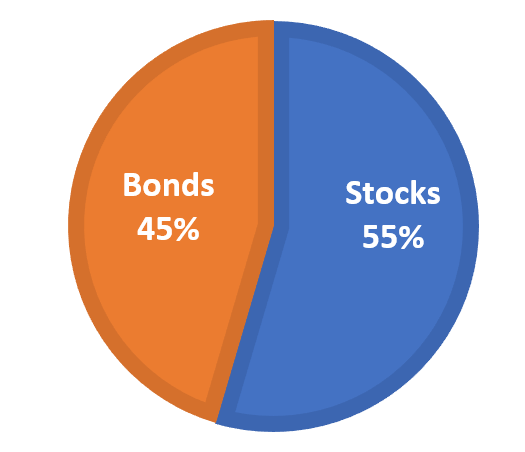

When the stock market goes down (and bonds stay relatively flat), your portfolio mix changes. A 20% drop in stocks results in the following portfolio if you were to make no changes:

A disciplined rebalancing strategy would sell 5% from bonds and purchase stocks to get back to the original 60/40 mix. This is primarily to make sure that your portfolio does not stray too far from the risk/return profile that gives your plan the best chance to succeed, but there is something else going on here. Think of what we are doing in this scenario—we are selling the “safe” asset and buying more of the asset that just suffered a severe drop in its price. That may seem counterintuitive, but over time we would expect to buy low and sell high more often than not.

Given the last four months, this actually worked out very well. Most portfolios sold bonds and bought stocks somewhere close to the low point at the end of March right before the rally. Without a disciplined strategy, it would have been easy to succumb to the panic and terrifying headlines. Rebalancing is a way to make us stronger whenever the inevitable recovery does come.

Moving Forward

Even though we’re all amateur epidemiologists at this point, none of us know what the future holds for this virus, the protests for societal change, or the election. And we certainly don’t know what any of that means for markets. Despite the unprecedented nature of “why” this has all happened, the historical lessons we’ve learned about “what” to do when markets get volatile have held up nicely and can be a roadmap for whatever the future throws at us.