Understanding Your RSUs

When people are offered new jobs or promotions, emotions are heightened because the process can move quickly. You’re presented with new information, and you need to make decisions in a timely manner. As a part of your new compensation, you see RSU. You’ve seen it before and know it’s beneficial but don’t know exactly what it means. You Google to find out more information, but that leaves with you more questions than answers.

RSU stands for Restricted Stock Units. These three letters can have a sizeable impact on your new compensation and your long-term financial goals. At TCI, we believe in taking the time to educate clients so they can have a more meaningful investment experience. So, let’s explore why companies offer RSUs, when you’ll receive them and how they can impact your taxes and financial plan.

What is an RSU?

Restricted Stock Units (RSU) is a form of equity compensation that employers grant to their employees. As the name suggests, these shares are restricted to a specific vesting schedule outlined by the company. By receiving RSUs from your employer you become a shareholder in the company. Companies offer RSUs for a variety of reasons: an employee retention effort, a means of recruiting top talent, cash conservation, promoting long-term company growth. RSUs are an appealing benefit for employees because if the company does well, their RSUs are worth more money.

It All Starts with a Grant

When you receive RSUs from your company, they are “granting” you these shares. You do not have to pay for these as they eventually become yours. On your grant date, someone from the company will let you know how many shares you’ll be receiving and the vesting schedule. One common misconception is that you might have to pay tax on the grant date. This is not the case since you do not own anything yet.

When a company grants you RSUs, they do so in a dollar amount. Then the company calculates how many shares you will receive. Each company determines this through their own calculation. The TCI equity compensation team is here to help you understand how this schedule will impact your long-term financial goals.

Let’s look at the information you receive on your grant date.

- Grant Date: 3/18/2024

- Granted: $100,000

- 30-day Volume-Weighted Average Price (VWAP): $50.00

- Shares Granted: 2,000

In this example, the company awarded $100,000 of RSUs. To determine the amount of shares the employee received, the company used a 30-day Volume-Weighted Average Price of the stock. This is a common practice for companies as it balances out the stock price over a period of time to account for potential periods of stock price volatility. The company then divides the $100,000 by the $50 Volume-Weighted Average Price to arrive at 2,000 granted shares.

What is Vesting?

The term “vesting” has come a couple times in this blog, so let’s clearly define it: Vesting is the process by which employees earn the right to own shares or stock options over time.

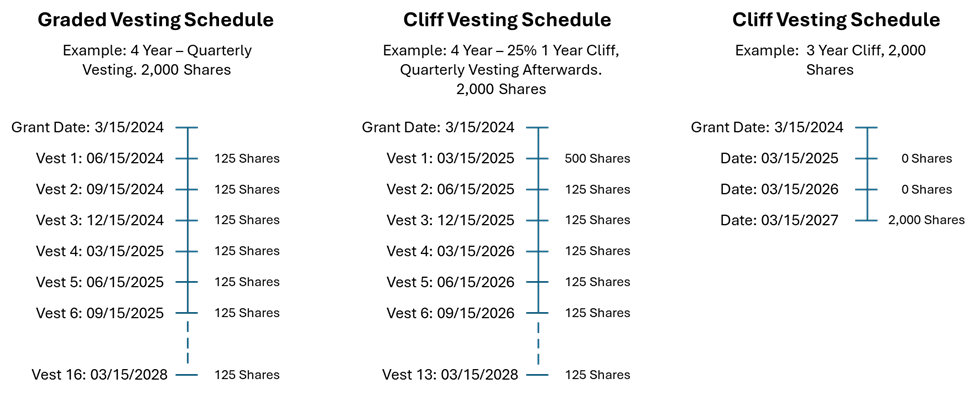

The two most common types of vesting are:

- Cliff vesting: Shares begin vesting after a specific period (e.g., six months, one year). All of the shares can vest at once on this date or it can begin the next vesting phase that recur based on a schedule unique to your company (e.g. monthly, quarterly).

- Graded vesting: Shares vest gradually over time with a shorter waiting period.

Here is an example to illustrate the differences between the two.

If you leave your company, any unvested RSUs at the time of your departure will be forfeited. This is why it’s important to discuss your equity compensation with an Advisor. Let your TCI team keep track of these dates, so you don’t have to. It would be a shame to lose RSUs simply by not considering your next vesting date.

Your RSUs Have Vested, Now Come the Taxes

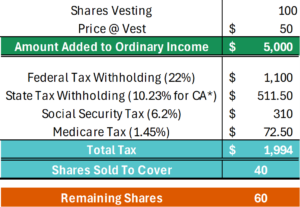

Vested RSUs are accompanied by two different taxes: income and, potentially, capital gains. When your RSUs vest, you officially become an owner of the shares, and this is considered taxable income. The value added to your W-2 is typically based on the closing price of the stock on the vesting day, multiplied by the number of shares vested. For example:

- 100 Shares Vest

- Closing Price of Stock: $50

- Amount Added to Ordinary Income: 100 shares x $50 = $5,000

This $5,000 is added to your income, potentially affecting your tax bracket.

However, due to tax withholding requirements, you may not receive all 100 shares. At the time of vesting, RSUs are treated as supplemental income, like a cash bonus, so taxes are withheld at the federal and state level. The default federal supplemental tax withholding rates are 22% if equity compensation income is less than $1,000,000 and 37% for any equity compensation above $1,000,000. A recent trend in equity compensation, is companies allowing their employees to choose what they want their withholding rate to be. Talk to your advisor regarding how RSU tax withholdings fit into your overall strategy.

In addition to federal and state taxes, you must pay Social Security tax (6.2% up to a wage base of $168,600 for 2024) and Medicare tax (1.45%, plus an additional 0.9% surtax based on your income level).

Your company will handle the logistics by either withholding shares or using a “sell-to-cover” method. On rare occasions, your company may allow you to use cash to satisfy tax withholding. Sell to cover is a common method used to satisfy tax withholding requirements on vested RSUs. Instead of requiring you to pay these taxes out of pocket, your company will automatically sell a portion of your vested shares to cover the tax liability. Let’s look at what vested RSUs look like with a sell to cover method.

* – Arizona, Colorado, and Nevada do not have supplemental income tax withholding

Based on this example, after your company sells a portion of your RSUs to cover your taxes, you now have 60 shares of which you are the rightful owner. The closing stock price on the vesting day becomes the cost basis for these shares. If you sell the shares within one year, any gain or loss will be short-term and taxed as ordinary income. If you hold the shares for more than a year, any gain or loss will be long-term and subject to capital gains taxes.

The Benefits of RSUs Are Not Guaranteed

Unlike cash bonuses, RSUs are tied to the performance of the company’s stock, meaning their value can fluctuate significantly over time. If the company’s stock price drops, the value of your RSUs can decrease, impacting your overall compensation. When compensated via RSUs, it’s crucial to understand the vesting schedule, potential tax implications, and your ability to sell the shares upon vesting. Additionally, consider your overall investment strategy and how RSUs fit into your portfolio, as well as the financial health and future prospects of the company.

At TCI, we work closely with clients to create strategies tailored to your specific goals and needs. We consider your unique circumstances to determine how your new equity compensation will influence your long-term financial plans. By thoughtfully considering and preparing for your vesting schedule, you and your Advisor can better plan for tax efficiency, insurance needs, and cash flow. Each of these elements plays an integral part in achieving your financial goals on a holistic financial journey.

Quick RSU Takeaways

- Restricted Stock Units are also known as RSUs.

- There is no taxable event on the day that your shares are granted to you.

- RSUs are subject to a vesting schedule. There are two types of vesting schedules: graded vesting or cliff vesting.

- You must remain employed at your company to receive any unvested RSUs.

- Once shares vest, they are yours whether you remain employed or not.

- There are two tax implications for RSUs: Income tax when they vest and become part of your income and potential capital gains if/when the shares are sold.