The Few and the Quick

By Sam Swift, CFA, CFP®, AIF®

Market returns are generated by a very small number of stocks in a very short window of time. Blink and you may miss it. Fortunately, there is an easy way to make sure the great engine of wealth generation does not pass you by.

We are in a key moment for investment management right now. The S&P 500, our most familiar proxy for the “market”, has been the best performing asset class for a significant amount of time now. This is a good thing as it represents one of the larger pieces of our investment pie. However, because of the familiarity, it becomes tempting to wonder if diversification is even worth it. Why include unfamiliar pieces to the investment puzzle if they haven’t even helped recently? There is also the question of whether or not we’re at a “market high”. Should we stay invested or “take profits off the table”?

We have to be careful that we don’t allow recency bias to inform our investment decisions for the future. After all, past performance is not indicative of future results. Today it’s been the S&P 500, but tomorrow it may be value, small, or international stocks. In fact, there are some jaw dropping numbers on the concentration of market returns that are worth exploring.

First, a very small number of stocks are responsible for most of the market return premium we see over long periods of time. In his paper “Do Stocks Outperform Treasury Bills?”, Hendrik Bessembinder finds that only 4% of all stocks ever listed are responsible for the long term out performance of stocks over treasury bonds (what we refer to as the market premium). Four percent! Said another way, the other 96% of stocks would have failed to return more than treasuries as a group. One could certainly spin that as a reason to try and pick one of those top 4% of performers instead of diversifying among all stocks. Then again, do you really want to put your financial future in the hopes that the 1 in 25 chance will pay off? Of course, the evidence bears out that very few professional active managers can do so—less, in fact, than we would expect by random chance.

The good news is that there is a surefire way to own those 4% of stocks: own all of them! Those outperformers have been the high tide that lifts all boats, thus a diversified strategy of stocks across the world continues to be the best way to ensure we will capture long-term market premiums.

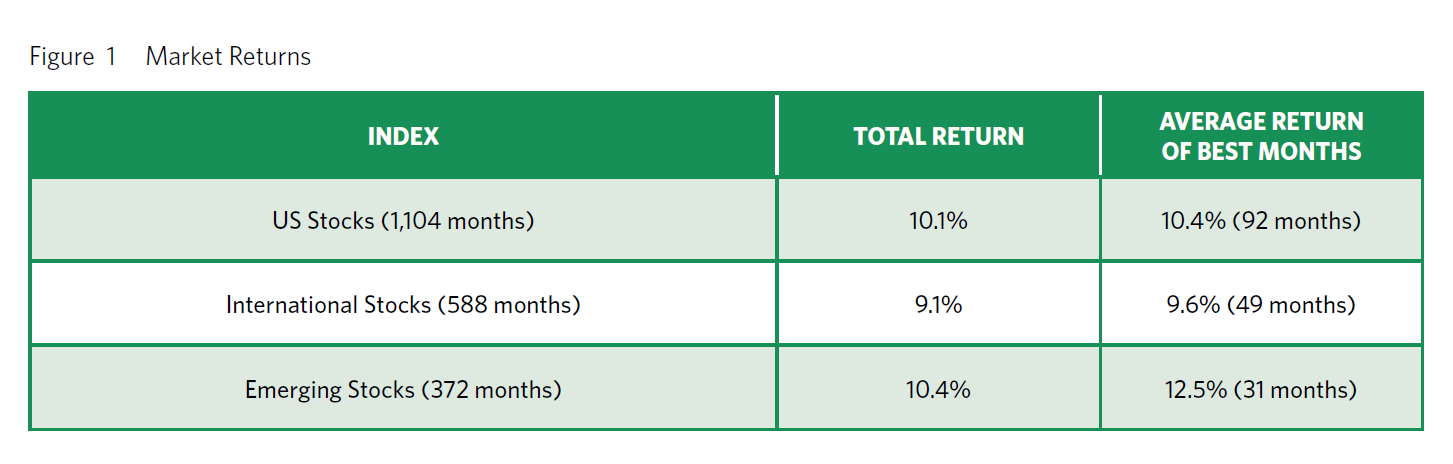

Second, positive stock market returns happen in very short bursts of time as industry columnist Larry Swedroe points out in a recent article titled “Unforeseen Distribution of Stock Market Returns”. Larry finds that across both the U.S. and International markets, about 8.3% of all months (1 out of every 12) are responsible for all of the market premium.

By staying focused on a long-term, disciplined strategy and resisting the urge to react to market movements, we give ourselves the best odds to meet our goals and grow our life savings.

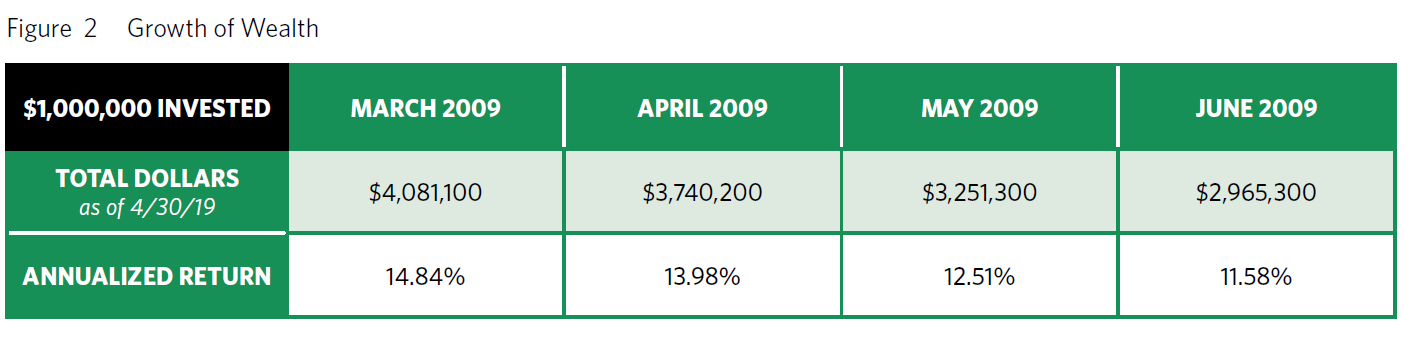

For a striking real world example of this, let’s go back to the start of the recovery following the 2008 market crash and assume that we have $1,000,000 to invest. Figure 2 shows the returns we would have experienced through April of this year in an all-equity portfolio had we invested in

different months.

That is a striking difference for each month that we weren’t invested. In the real world, we saw people who had sold out and were unwilling to get back into the market until the “news looked better”. Unfortunately, by the time the news looks better it’s too late. Waiting 90 days would have resulted in a difference of 25% to one’s net worth which is a major cut in a resource designed to help achieve purpose in life.

While it may be tempting to use concentrated market returns as a reason to concentrate your portfolio, it’s actually great evidence to do just the opposite. Missing the best performing asset class or the best performing month in any year can be impossible to make up. But if you own everything at all times you will always capture the right returns at the right moment.