Back to Basics | Part II

We finished last week’s post with two revelations that spring from the efficient markets theory:

- It’s very hard to exploit “mispricing”, if not impossible, after accounting for the costs to do so.

- The “market portfolio” is a very efficient portfolio, and you better have a good reason to deviate from it.

We continue this week with more investing basics and our investment strategy to provide clarity and understanding so you can be a transformed investor.

Challenges of Stock Picking

The first revelation is represented by the failure of traditional active management. Stock picking and timing in order to try and beat a basic market portfolio is extremely challenging, and that’s before accounting for fees. Let me bring up an important point here as well: the failure of active management does not mean that we never see an active manager beat the market. But far more often the market beats the active manager, and/or the management fees wipe out any advantage gained.

Remember one of our initial principles: for every buyer there is a seller, and someone will “win” that transaction. Taken in aggregate, for every investor that “beats” the market average another investor will have underperformed. Thus, by sheer chance, we would expect that 50% of managers will outperform the market in any given year and 50% will underperform. Unfortunately, the real numbers we observe show that less than 30% of managers beat the market on average and about 70% underperform. So some managers do, in fact, beat the market. But it begs the question as to why fewer than we would expect do so.

The next logical test is to observe the 30% who do beat the market. If there is skill in exploiting “mispricing” then we should see that continue for the outperformers. Unfortunately, there is no correlation between what a manager has done and what they will do in the future (there is some evidence that very bad managers will continue to be very bad managers, for what it’s worth). Said another way, “Past performance is not indicative of future results”—that pesky little disclosure highlighted in every ad that so many choose to ignore!

So do we accept the market portfolio and call it a day? Although that is a good strategy, academic studies present good evidence that there is value in deviating from the market portfolio. If we think of active management as a D-minus grade and an indexed market portfolio as an A-minus, we’re really just trying to explore if we can get to an A-plus. Because of that, the evidentiary bar must be set pretty high.

Premiums

Fortunately, that bar has been cleared in the discovery of four premiums. A premium refers to the extra return one can expect for one class of assets over another. These four premiums are:

- The market premium—the excess return we get for holding stocks over risk-free T-bills.

- The value premium—the excess return that value stocks produce over growth stocks.

- The small cap premium—the excess return that small stocks produce over large stocks.

- The profitability premium—the excess return that stocks of highly profitable companies produce over the stocks of less profitable companies.

These premiums are relevant because of how robust they are—that is, they show up over different time periods and in different parts of the world.

There are frequently papers published that claim to have found a new premium, but the flaw in almost all of them is they are very limited to a specific data set. For example, perhaps someone notices that companies with high technological investment produce higher returns than those with low technological investments. Interesting! And worth exploring. The problem is that what often happens when you dive deeper is the lack of robustness. High technological investment would have been a good indicator of returns in the late 90’s in the US during the dot com bubble. A true premium, however, would need to show up during different time periods and in different locations to be reliable enough to place a bet on. That’s what makes the four listed premiums so special. Pick a random time period and a random location and the odds are overwhelmingly likely that you will observe excess return.

Investment Portfolio Strategy

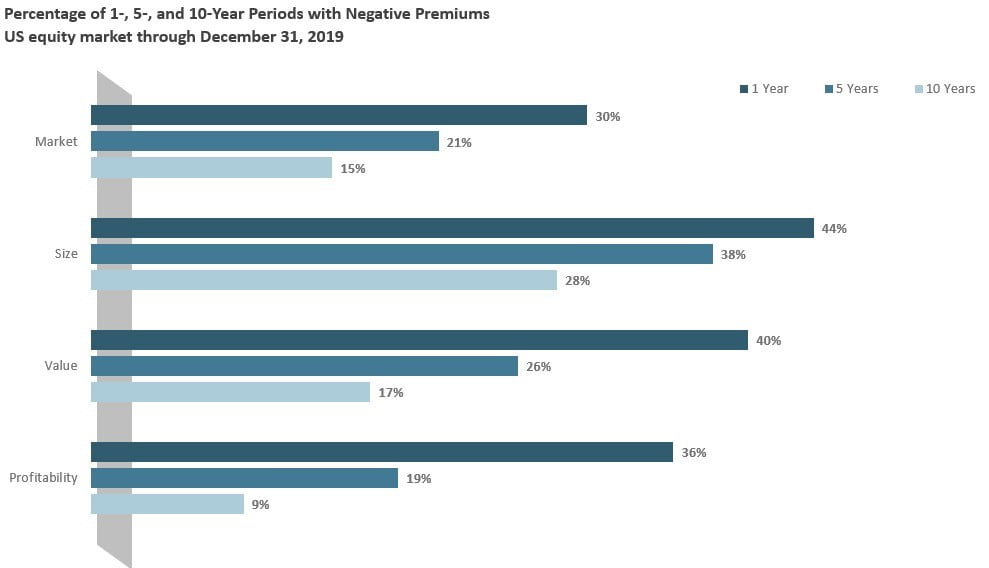

Just as there’s no guarantee that stocks outperform risk-free T-bills, of course, there is no guarantee that the value, small, and profitability premiums show up at any given moment. You are, however, putting the odds in your favor by tilting a portfolio to include all four premiums. Over any ten-year time period, you would expect the profitability premium to show up 90% of the time, the market and value premiums to show up over 80% of the time, and the small premium to show up over 70% of the time (see chart).

Astute observers may be nodding along that this is all well and good, BUT—and it is a big but—we just witnessed a negative value premium over the last ten years. That is true.

In the next edition of Back to Basics, we will explore this further to determine the fundamental reason premiums should exist and how to position a portfolio coming out of this crisis.