As I am writing this, the Dow Jones Industrial Average is at 29,915 and ticking up. I have no idea where it will end up today and whether it is going to rise or fall tomorrow, the next day, or the day after that. But I’ve been tracking it all week in the same regard as I watched Dustin Johnson play the final round of the Masters on Sunday. I’m a casual golf fan and think Dustin Johnson is the most fun player to watch on the tour, so I was happy to see him win. It was fairly obvious, especially on the back nine, that he had the tournament in hand, and I found myself less intrigued by the competition playing out than Dustin’s score relative to par. He was chasing history.

On the thirteenth hole Dustin Johnson birdied to put himself in a position to tie the lowest overall score at a Masters tournament—18 under par held by Tiger Woods and Jordan Spieth. On the 14th hole he birdied again to take the outright record. That was impressive, but I thought it would be fun to see him get to 20 under par. I can’t really tell you why, 20 under par is just a nice round number and seems like it would carry more weight than 19 under par, despite the fact that Dustin Johnson would hold the record with either score. On the 15th hole, Dustin birdied for the third straight time to reach 20 under par. Boy did that make my day.

Now, back at the home office, I keep refreshing Yahoo! Finance (now the Dow is down to 29,905) because I think it would be really exciting to see some financial history and watch the Dow Jones hit 30,000. Let me be clear though, the only reason why I am interested in the daily movement of the stock market is because of the novelty of 30,000. As a long-term investor, I really don’t care to any significant degree what the market does today.

Let me tell you why…

Market Speculation Is Dramatic

First of all, speculators are already saying that the market is over-priced, so any new records are only going to fuel short-term trading activity. Just because the Dow Jones hits 30,000 (now at 29,817…wrong direction) does not mean that it is going to stay there. In fact, it likely won’t, as speculators and technical analysts will probably use 30,000 as a new short-term benchmark to trade on and around, meaning sell when above and buy when below. At some point the market will decide on a new floor or ceiling—depending on your perspective—and 30,000 will become an arbitrary number. Again, none of that matters to the long-term investor other than the novelty of it all. Who doesn’t like a little drama?

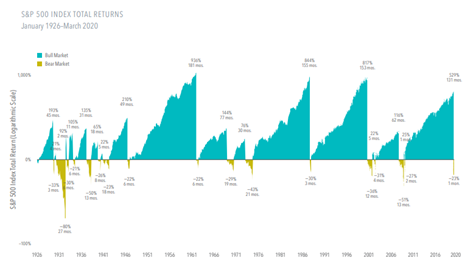

And drama indeed! Watching the market day-in-and-day-out in 2020 has been nothing short of exciting, prime time entertainment. It continued to defy expectations early in the year when the long-awaited bear market failed to show up (same as 2018 and 2019). Every forecast was wrong. Then the pandemic hit, and the precipitous fall towards a very deep bottom in mid-March was accompanied by some of the largest one-day swings, both up and down, in history.

Timing The Market Can Cost You A Lot of Money

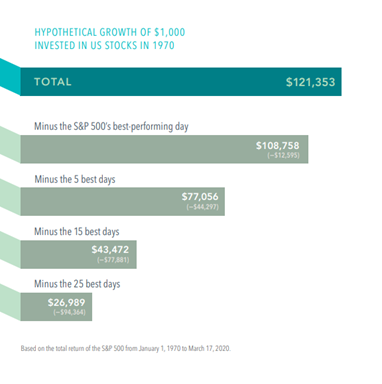

A lot of long-term investors panicked at this point, lost their discipline, and got out of the market. That is always a bad idea. If you tell yourself that you need to get out of the market now, then how do you make the decision for when to get back in? Missing just a few days in the market is costly to your overall portfolio performance. Missing the best performing day can drag your portfolio down by ten percent. Miss the five best days and you lose out on nearly 35 percent.

No one knows when the best days are going to happen, and if any one tells you that they do then you should ask to spend a week on their private island in the Caribbean, or the Virgin Islands, or both.

OK, back to the show.

The federal government came to the rescue with its stimulus and an attempt to keep people spending and businesses from folding. As interest rates kept hitting record lows, everyone decided it was time to buy a new house, and the markets started to look up.

But WAIT! All indicators pointed to a pending meltdown. The economy just would not be able to handle continued lock downs, rising unemployment and pandemic panic. When the Dow hit 27,000 in late-May / early-June, a lot of investors called it quits on the bullish mindset. 27,000 was just too high. 25,000 to 26,000 felt better, so people speculated around those benchmarks for a few weeks. Interest rates kept ticking down, however, and certain companies and sectors—think NASDAQ—were benefiting in big ways from the “new normal.” In mid-August the Dow hit 28,000. As if they already weren’t before, now things were getting interesting.

Bad Markets Aren’t as Bad as You Think

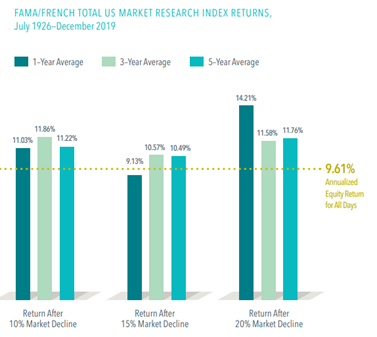

This whole time, long-term investors kept making contributions to their investment accounts and stayed away from the speculation. Consistent contributions ensure that you don’t miss out on favorable buying opportunities. We call this dollar-cost averaging. Bad markets are just not something to shy away from. Especially because the bad is not nearly as significant as the good that comes with a good market.

Also, market returns have been historically positive following sharp declines, so they are a lot less scary when your investment strategy is not predicated on the short-term.

The Dow Jones Marches Towards 30,000

Throughout late-August and September the Dow settled into a little rhythm, 27,000 to 28,000, and good news and bad news seemed to offset itself. It felt like the writers of our economic thriller were placating emotions so that there would be plenty to go around when the November elections were set to determine the fate of civilization as we know it. All indicators pointed to a hotly contested presidential race, and it was pretty obvious that we were not going to have a clear winner on November 4. Markets don’t like a lack of information, and this would qualify as a lack of information. All of the polling was also predicting a blue wave in the House and Senate and a new Biden administration. Clearly that would have an impact on the markets as well (see How the Election Could Affect the Market). Speculators geared up to take advantage of the impending volatility. Long-term investors stayed disciplined.

The market did drop into 26,000 territory between October 19 and October 26. The campaigns were heating up, a second stimulus was looking less-and-less likely, and COVID-19 cases were rising at a steady rate. Oh, and we were now eight months into global lock-down with no specific end in sight. Nerves were starting to fray.

That twist in our 2020 epic was less explosive than anticipated—thankfully—but a good piece of writing, nonetheless. Republicans actually did better than Democrats in down ballot races and Biden won the presidential race to split the legislative and executive branches and effectively cause a stalemate to any major policy shifts that would have occurred with a Democratic administration and Congress. Not the best news if you are a Democrat or Republican, but the markets seem to be loving the outcome. Pair those results with some timely news that a vaccine (or two) is on the way and we find ourselves looking at 30,000 on the Dow any day now—it’s now at 29,438… doesn’t look like it is going to happen today so we’ll try again tomorrow. I don’t know if the Dow will actually hit 30,000 any time soon, and, to be honest, I really don’t care. Just like it was fun to watch Dustin Johnson make history at the Masters, I am interested in the novelty of the Dow’s drama-filled 2020 and its own historical journey. I’ll watch the Masters again next year with the same level of casual interest, and I’ll do the same with the Dow. Although, I wouldn’t mind if the script for 2021 were a little more mundane.