Discipline, Adaptation and the Key Components of a Strong Financial Plan

I posted an article a few months ago — about six weeks into the pandemic — reassuring parents that Our Kids Will Be OK… And So Will Our Financial Plans. Despite the terrifying headlines in your daily news feed, I’m still right. First of all, anyone claiming that “it’s time to rethink how we plan for retirement” never had a good long-term plan in the first place. Good, long-term financial planning takes world events and economic downturns into account. As for our kids, well I’m no expert, but I have a strong feeling they are doing better than we are. We keep watching the news, over and over and over… they keep watching Mickey Mouse Clubhouse. I don’t care what you say about that show, we all learn WAY MORE from it than we do from watching the news. It’s not even up for debate. Our kids are doing better than we are.

One of the reasons we are struggling is we feel like things are not going according to plan. Of course, we are in the midst of a wildly unprecedented and historic period of time that is impacting things now and will certainly impact the future. But if your plan only accounts for the predictable, then you don’t have a plan at all.

There are two key elements to a successful financial plan, in good times and bad: discipline and the ability to adjust. In fact, take the financial part out of it. Discipline and the ability to adjust are the two key elements to any good plan, period. It is easy to be disciplined and adjust when things are going well. Especially over the past ten years, we’ve had a lot of practice with executing our plans in the midst of good economic forces. Stick to the savings plan and make the necessary adjustments when the market consistently outperforms projections. How hard is that?

But how often do we get to practice activating that part of the plan that calls for discipline and flexibility in the face of the storm? As Mike Tyson famously said, “Everyone has a plan until they get punched in the mouth.” Here’s the thing, when you get into the boxing ring you expect to take a few punches and when you invest in the stock market you expect to encounter volatility. But, that doesn’t mean that it feels good when it happens. Our problem is that we just don’t practice taking those punches enough, and we are more likely to lose faith in our discipline and adapt in the wrong way when we are not conditioned to face adversity. We don’t like it when it feels bad because we are too used to it feeling good.

The past few months have been the first major economic downturn we’ve faced since the market crash in 2008-2009. Remember how that one felt. Ten years is a long time to go without working out that adversity muscle. If you haven’t been punched in a long time, you forget how it feels.

So what are we supposed to do now?

The first thing we must do is recognize — and say it out loud — that we are facing adversity. We are taking punches. We need to activate that part of the plan that is specifically in place to deal with that. Remember to focus on the discipline and the ability to adjust. For this part of the plan to succeed, you need be good at both right now.

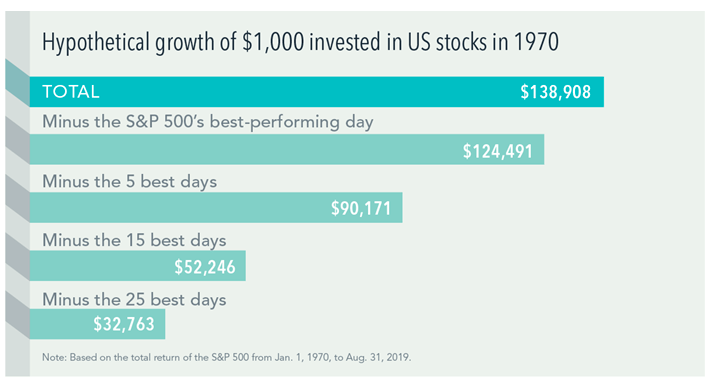

Discipline: Be a Good Long-term Investor

A lot of people want to get out of the market right now. One good punch is enough to make even the stoutest among us to consider the comfort and safety of getting out of the ring. The thought goes something like this: “I’ll just get out of the ring now and wait for a less daunting opponent to face, one that I know I can beat,” or “I’ll just wait for the market to settle down and come back.” Here’s my question to you. How do you know when to get back in? The answer is that you don’t. How do know which opponent to choose next? The answer is that you don’t, and that can be very costly. Take a look at the chart below from Dimensional illustrating the effects on investment returns when missing out on the best market days. This is a very real scenario that many investors were just faced with when the market dropped back in March. Since then we’ve seen some of the biggest market days on record.

The opponent may be scary and pack a big punch. But when you think you should get out of the way, any good boxing coach will tell you to do the exact opposite: tuck your chin and move in closer. In other words, rebalance the portfolio, selling high and buying low. Stay disciplined and be a good long-term investor. Also, keep your hands up.

Ability to Adjust: Practice Sound Finances

I’m going to be really honest, we may be in for a long fight. We don’t know what the market is going to do and the economy is still working itself out as it waits for a vaccine and the elections in November. We will very likely experience more volatility and stagnant growth in the next 12 to 18 months. When it becomes clear that a match is going to go into the later rounds, you have to apply strategy and tactics to shore up your defense and conserve energy. You have to activate the part of the plan that is in place specifically to deal with the adversity.

If you haven’t done so already, now is a good time to adjust your spending. Find those places in the budget that just aren’t necessary right now. For those who are drawing on the portfolio, even a ten percent decrease in portfolio draw can have a big impact on mitigating negative effects on the account. For everyone else who is still working, spending less will give you the ability to build up extra cash. This can help by giving you the ability to avoid tapping into long-term savings, or it can provide opportunity to go on the offensive and buy into the market when it is particularly cheap. The S&P 500 is up around 40% since it hit its low point during the pandemic back on March 23, 2020. That was a big discount, and a major opportunity for a powerful counterpunch.

The point is a good plan has built within it a plan to face the inevitable adversity. It is time to activate that plan.

Get Yourself in the Right Mindset

What do you do when you find yourself in the ring with a scary and powerful opponent? Say to yourself, “Good.” Accept and embrace the challenge. If you don’t face the bad now, you won’t be prepared to face it in the future. Stay in the ring and meet the adversity in front of you. Doing so means the next opponent won’t be nearly as scary and you’ll be better prepared, better trained and more soundly tested to take on that challenge. What we are dealing with in the year 2020 is not fun — we are facing a tough opponent in the ring — but I very much believe that we are all going to come out of this better for it.