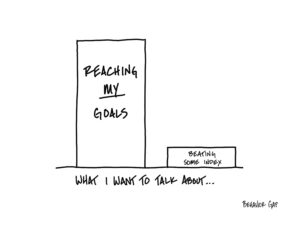

Investing, by definition, is a long-term exercise. It’s not about what happened yesterday or what may happen in the next month or so. For most of us, it’s about how the markets will perform over the next 25 to 30 years or more so that we can achieve our long-term financial goals.

Speculation on the other hand is not investing, it is letting emotions come into play. Speculation is focused on the near term. When markets are up, we sometimes wonder, “Is now the time to put money in, or should I wait until the market goes down?” When markets are down, we may feel the fear of loss scare us away. Sound familiar?

The reality is that emotions can affect us all. It’s something I’ve observed in long-term clients I’ve been assisting for years. Likewise, it occasionally becomes apparent in new clients who might be experiencing a sense of relinquishing control over their investment decisions, perhaps for the first time. There are moments when clients who have recently come into a windfall also exhibit these emotions, as they worry about the possibility of putting their funds in the market and witnessing a decline.

To be honest, there are times when I feel emotion around investments, too. Nothing is more human than having emotions both positive and negative, the important part is not letting them interfere with your long-term plan.

So, what might have piqued our emotions, thus far, in 2023?

Earlier this year, the congressional battle over the debt ceiling seemed to be a significant source of concern. But we weathered the storm just like we often do–in an 11th-hour deal. Meanwhile, many investors wanted to put some money on the sidelines, but in doing so they would have missed out when the deal inevitably happened, and markets reacted positively.

We survived the “banking collapse” which really was not a collapse at all. A couple of questionably managed banks went under and sparked a ripple effect. U.S. Treasury Secretary Janet Yellen did the right thing, everyone’s deposits were guaranteed (even above the $250,000 FDIC limit), and the situation quickly stabilized.

Rising interest rates have been a major headwind this year, but they’ve finally seemed to level out. Inflation seems to be leveling out, too, if not retreating a bit. The U.S. is back to a near-normal employment rate. And the big question is whether we will go into a recession or escape with a soft landing. It can feel like the market is trying to figure this out every day.

Without question, many key financial sectors are doing well. Earlier this summer, both growth-oriented and technology stocks were outperforming. In July and August, positive momentum became more widespread, seeing international and U.S. small-cap stocks rally. Real estate indexes have started to come back. Even bonds, which have been hurt by rising interest rates, are beginning to steady and turn positive.

Many analysts see overall trends as encouraging. But there are pessimists, too. We don’t have an opinion. At TCI, we’re long-term investors and we do not try to time the market.

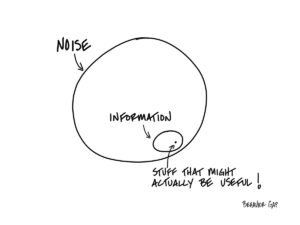

These stories are simplified summaries of events so far this year. My point is that any news source or pontificator may proffer their explanation or projection on what might happen in the short-term following what is deemed a newsworthy event in the financial world. While there can be long-term financial planning elements involved with these kinds of events, they also have a high potential to engage emotional thinking or speculation. We are here to help you sift through the noise.

In our opinion, there’s simply too much data available for anyone to predict successfully and consistently what will happen in the short term.

At any one time, if you believe in the efficient market hypothesis, a given stock is trading at the right price based on all of the information that the world already knows. By extension, the entire market is priced properly, based on the news and facts available.

Given the efficient market hypothesis, the only way to consistently outperform the market is to have information the rest of the world does not yet have, which is typically illegal to act upon. Or, maybe you have a different way of interpreting information, which is what the ‘market gurus’ of the world are always trying to figure out. When it comes to long-term planning, we do not believe this is a valuable use of time nor the best way to approach investment strategy.

Bringing emotional decision-making to investing means we are stepping out of the objective, feeling compelled to try and control something beyond our control.

How can we control our emotions?

One of the best ways to overcome the influence of emotions is to have a plan…and good news, we’re planners! When we work with you to create your own investment plan, we intentionally include guardrails to limit your exposure to risk. If something does not feel right to you, if you are losing sleep at night, let us know – that is something we should talk about very soon.

Within the firm, each of our advisors and colleagues has access to their own advisor who acts as a financial coach and helps to navigate the influence of emotion, just as we do for our clients. When we advise you to set out on a course of action, we follow up to make sure you are accomplishing it. We do the same internally. Advisors at TCI help other colleagues focus on doing the right thing, which includes not reacting to emotional triggers.

You can overcome emotional triggers, too, by limiting your reaction to market noise. This noise may include financial news, op-eds, podcasts or even your neighbor’s “hot tips.” Whether markets go up or down in the short-term, it is okay to pay attention. However, consider that market noise is transitory at best, and not an indicator of long-term performance. If you’re in the habit of checking your portfolio frequently, try to do so less often. And similar to life in general, do not make critical decisions when emotions are running high.

Remember, money is nothing more than a tool to help you achieve your goals and investing is a way to do so. Think about your goals and your purpose and share that vision with your advisory team at TCI. We are here to help you plan.