Perspective Matters A Lot

Five months into 2022 and markets are down. There is a lot of daily volatility, and the headlines will have you thinking that there is no end in sight. When investors see the value of their portfolios drop, they naturally start to question the efficacy of their investment strategy. They also tend to kick themselves for not “getting out” when all indicators were pointing to the obvious. We’ve all felt that way, and anyone who says otherwise is a robot. There is absolutely no shame in feeling the pressure, especially after the past two years when we faced a seemingly endless cascade of crises. Nerves are understandably on end.

Some Quick Thoughts on What’s Happening in the Market

- This is, for the most part, a reversion to the mean. The last three to four years have been so good and way above average that the markets (everyone) essentially went into 2022 “ahead of schedule.” Short-term investors have been waiting for this to happen and are using world and economic events as the excuse that they needed to make these adjustments. The good news is the recent downturn has brought price-to-earnings ratios closer in line to historical averages and off of those historically high valuations we saw at the end of last year.

- Markets are forward-looking, so are pricing in expectations for the next 3-6 months. There is not yet a foreseeable conclusion to the war in Ukraine (which is affecting oil and gas prices), the global supply chain issues being solved and markets are pricing in expectations of the Fed continuing to raise interest rates to fight inflation.

- Undisciplined investors have been “getting out,” which is never the right decision, but nonetheless has been contributing to a sell-off that is driving down prices. At the same time, day traders are looking to take advantage of that and creating big day-to-day swings, which only exacerbates the nerves of the nervous.

There are an endless number of factors contributing to the volatility, but one thing is certain. No one knows when the market is going to turn around. When it does, no one knows for how long or when the next downturn, correction or crash will be.

Perspective matters, however. For the short-term speculator, 2022 thus far is a throw away year. Returns are not good any way you look at it. Returns are great for the long-term investor. That’s because one month and year-to-date returns don’t actually matter whatsoever. We all like to see positive returns on any given day, but if the market returns +20% or -35% in a given year, the only thing that matters is what the markets do over time.

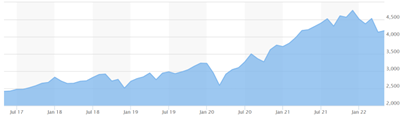

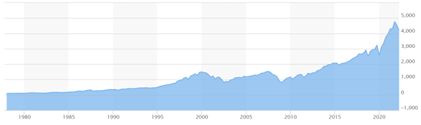

To truly gauge market performance, you have to zoom out. Take a look at the returns for the S&P 500 over its historical timeline:

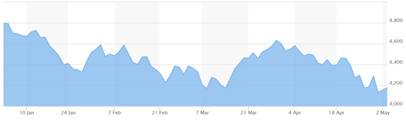

One Month (bad)

Year-To-Date (bad)

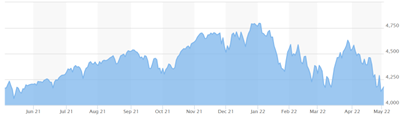

One Year (not great, but not bad)

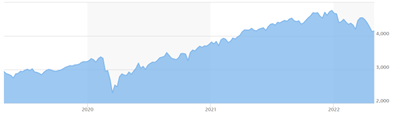

Last Three Years (good)

Last Five Years (great)

Last Ten Years (really great)

Historical (…you get the point)

Charts generated by marketwatch.com

So given the right perspective, here are a few more thoughts that are way more important than the ones I mentioned earlier:

- This is an anticipated market correction – no surprise after 3 great years in a row.

- Your retirement planning does not change at all due to short-term down values.

- The answer is to hold tight, keep buying – all is fine. (don’t look for a while!)

- Inflation is needed long-term, but always disrupts short-term markets.

- Ultimately rebalancing and additional investments take full advantage of buying “at discounts.”

- Discipline is the most important factor to a successful investment portfolio and financial plan.

The bottom line: discipline requires perspective.