3 Reasons Why You Should Avoid Annuities

Part of the reason we started this blog was to provide some clarity in an increasingly noisy financial world. Most mainstream financial outlets do a good job detailing different investments and rightfully point out the problems in bad products. Unfortunately, they’ll frequently end with a hedge that says, “Despite the flaws, product [blank] may make sense in some circumstances. You should consult your advisor…blah, blah, blah.”

I’m an advisor. I’ve been consulted. Let me make it easy for you, when it comes to annuities: Say no and here’s why.

First, here’s a brief refresher about annuities. According to Investor.gov, annuities are a “contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future.” There are really three types of annuities that you may hear about: fixed, variable, and equity-indexed. Of course, insurance companies have been marketing many new versions that can confuse the situation, but those three options form the basic framework.

Let me take a brief pause to point out the “theory” of annuities is very solid. The application of said theory, however, is where we run into problems.

From my viewpoint, the fixed annuity is the only type worth considering and even then it will only be a potential tool for your financial plan much later in life. Furthermore, if you’re eventually considering the fixed annuity as a tool, you will still have to find one that avoids high fees (much easier said than done) and other pitfalls that plague the annuity world. Some companies are beginning to get better at this and offering much better products than in the past, but they still have a way to go.

Let’s leave fixed annuities out of the ensuing discussion and instead give a (deservedly) hard time to variable and equity-indexed types.

1. Annuities are Being Sold to You

The first indication that you may want to be skeptical of an annuity contract is that they are sold to you. In all my time in this industry, rarely do I hear about people going out of their way to buy annuities.

2. Annuities Don’t Make Sense in Terms of Tax Strategy

As a selling point, you’ll often hear annuities are tax-deferred. First, it’s not that hard to get money into tax-deferred accounts. Workplace retirement plans like a 401(k) allow for sizable contributions each year. Second, I’m not convinced that tax-deferral is always the best strategy anymore. I’ve seen many older clients stay in high tax brackets even in retirement, and that’s before taking into account that tax brackets may very well be going up in future years. Not only is tax-deferral not necessarily the benefit it’s made out to be, but many annuities I’ve seen have been purchased within an IRA or a Roth IRA. Both account types already have the potential tax benefits, so they shouldn’t be used as a selling point for the annuity in the first place.

3. Annuities Can Over Promise and Charge High Fees

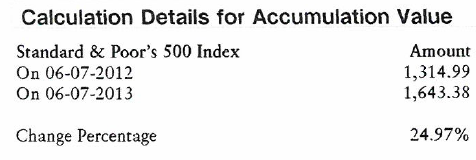

Here’s a real-life example from nearly a decade ago that’s always stuck with me. A client brought in her equity-indexed annuity that promises 70% participation if the S&P 500 is up with a guarantee that the value can’t go down. In other words, if the S&P 500 goes up 10% her account will get credited 7% (70% of 10%). If the S&P 500 is down 10%, her account doesn’t lose value. Here’s what the S&P 500 did per her annuity statement:

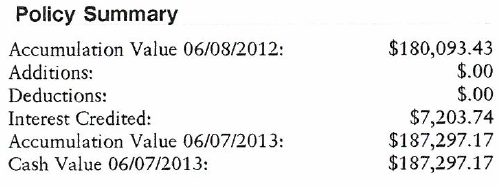

70% participation on 24.97% is 17.48%. Not bad! So here’s what the account was credited:

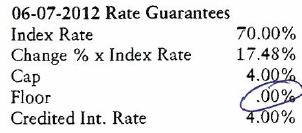

Hang on while I check my calculator. Yup, 17.48% of $180,093.43 is a lot more than $7,203.74! So, what’s the catch? Well it turns out there’s some hidden costs here. Namely, the insurance company has to put in some sort of cap on “Interest Credited” otherwise they’d be losing money over the long term if they’re paying 70% of every market upswing and absorbing 100% of every market downturn. Let’s take a look:

The cap is 4%! If the market returns more than 5.71%, she hits the 4% cap! In the past 87 years, based on the dates of the client’s statement, using June as the anniversary date as this contract does, there were 21 years where the return was negative. People would have been happy there was a guarantee of not losing value. Of the 66 years where there was a positive return, 54 of those years exceeded the 5.71% threshold and would have been subject to the 4% cap. The average excess return over the cap that someone would have given up was 14% per year!

(I sincerely apologize for the excessive use of exclamation points, but this is unbelievable to me!!!!)

With this equity-indexed annuity, despite all the bells and whistles you end up with an investment that will return between 0-4% every year. You could buy a U.S. Treasury bond fund and expect remarkably similar results without the high fees and illiquidity.

Let’s not forget about these terribly high fees people pay for the privilege of owning what amounts to a ridiculously complicated bond. There’s most likely a surrender charge that usually starts around 5-7% and slowly decreases until it goes away 5-7 years from now. There’s a high internal “mortality and expense” fee that probably adds up to 1-2%. In the case of the variable annuity, you’re most likely subject to terrible investment options that cost another 1% over their index fund counterparts.

A big-selling point for annuities comes from a place of fear. The annuity industry recognizes that people may be uncomfortable with market volatility because, as we know, there is tons of noise surrounding financial headlines. However, as long-time readers of this blog know, TCI believes in a tax efficient, globally diversified portfolio focusing on long-term results. By the way, if you’re not comfortable with market volatility, and you’re a young investor, read this blog. The bottom line is that these products promise the potential for the annuitant to participate when the market goes up, but still have some protection for themselves when the market goes down.

Answers aren’t always this cut and dry when it comes to personal finance, but this one is. You do not need an annuity.