The Power of Time

I mention the power of time a lot on this blog, but I really can’t emphasize it enough. Without a doubt, it’s the most powerful asset a young investor has.

Another advisor was relaying a terrific story to me the other day that applies here. He has a client in his mid-90’s who received a call from a brokerage firm that had been trying to track him down for some time. Apparently there was an account in his name that he opened 35 years ago with $5,000, but he had failed to update his address as he moved around and had basically forgotten he ever had the account. Naturally, we said we would help him transfer the money over to his current accounts just to simplify his situation and didn’t think all that much of it.

Well when we got the paperwork it turns out the account was worth $290,000! 58 times his original deposit!

When you do the math on that, it actually comes out to an annualized return of a little over 12%. Now, this client did happen to have invested in one of the great mutual fund success stories of the past 50 years, but even a more “normal” 8, 9, or 10% return would have produced amazing results over that time frame. Also, this was just a one-time deposit that never had money added to it again.

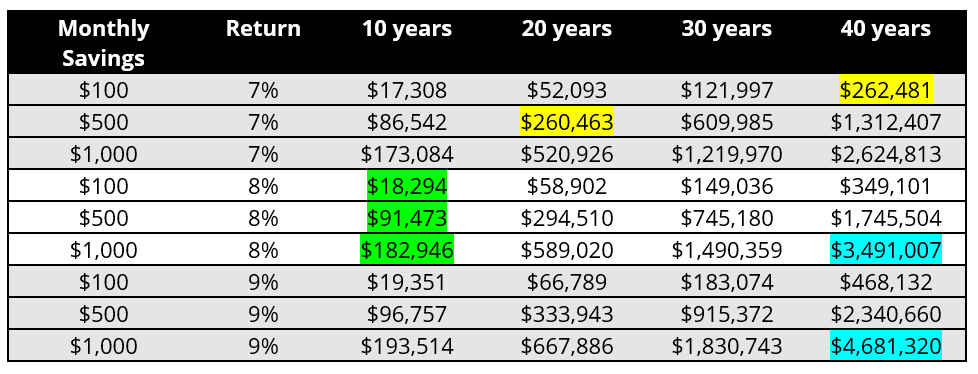

What I want to do here is show you the power of time combined with the power of consistent savings. The chart below shows different monthly savings amounts at three different returns and then the corresponding value the account would hit at different time intervals.

There’s a lot of interesting information if you stare at this long enough, but let me just point out a few things. First, take a look at what I’ve highlighted in green. Monthly savings of $1,000 at 8% is exactly double in 10 years what $500 monthly savings at 8% would have accomplished. The $500 savings number is then five times what the $100 savings number is. This may have been obvious to you, but it’s worth repeating that if you save five times as much, you’ll have five times as much later.

Second, I want you to look at the power of the return component—I’ve highlighted this example in blue. The difference between 8% and 9% over 40 years is quite significant—9% has a terminal value nearly 35% higher than the 8% return! On a year to year basis that 1% difference doesn’t necessarily seem like a lot, but it’s amazing what the compounding can do given time. There are two important takeaways from this particular lesson.

- Let the market work for you and don’t panic with each bump. The roller coaster in the short-term is what ultimately produces the higher long-term returns as long as you stick with it.

- Keep fees low! Let’s say you invested in an S&P 500 index fund that returned you that 9% over 40 years. Unfortunately, your friend thought he could do better and chased an active mutual fund that cost an extra 1% yearly in fees. Even if the underlying returns after 40 years were the same in both funds, that 1% in fees cost your friend over $1.2 million in the end!

Finally, I want you to look at a strict comparison of time periods—I highlighted this example in yellow. A lot of young people I talk to say they want to start saving, but don’t think it’s worth it since they can only put away $20 per paycheck, for example. Well, if you kept putting that off for 20 years you’re wasting away your most valuable asset—time (in case I hadn’t made it clear enough yet)! $100 per month over 40 years grows to the same amount as $500 per month over 20 years. If you only give yourself a 20 year time horizon to save, you’re going to have to put away five times as much as you would have had you given yourself a 40 year time horizon.

Start early (even if it’s a small amount), maximize your return (keep your fees low and don’t panic), and let the power of time do the rest.

Looking for your next financial read? The Psychology of Money, has been an informative book that I’ve been enjoying this summer. The lessons presented closely align with many of the philosophies we believe and practice at TCI. Here’s an overview taken from the book’s jacket.

Money—investing, personal finance, and business decisions—is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together.