Learning to Love Long-Term Goals

This new year has welcomed a new routine into my household: chores! My son is now six years old and has been looking for some responsibility and a way to get some more things he wants. Somehow, he hasn’t figured out the obvious option of buttering up either grandma, thus, chores it is.

We’re starting small, of course: cleaning up after yourself, putting your stuff away properly when you get home from school, getting yourself ready for school, etc. You know, the things that start to make someone an independent person. If he does all those things successfully during each day, he gets $1, and a perfect week gets him a bonus dollar on top. His success in these endeavors will save us so much time as parents that we will be thrilled to pay him for 52 perfect weeks if he can pull it off.

Witnessing Money Frustrations

Having said that, one of the fascinating parts of this new endeavor has been watching someone so young have their first real interactions and frustrations with earning money, setting long-term goals and practicing delaying gratification. As a financial planner, it obviously hasn’t surprised me to see him hit speed bumps as he’s learning. To his mother and I, that’s the point! Learning the value of a dollar—indeed, that the money is a means to an end—is the lesson we intend to impart.

So, how do long-term financial goals with kids relate to adults along their own financial journey? Well working towards accomplishing long-term goals requires patience whether you’re saving for a toy dinosaur or the flexibility to make future decisions free of a huge financial burden. The tricky part for people of any age is being patient enough to see long-term goals fulfilled.

Patience is a Virtue

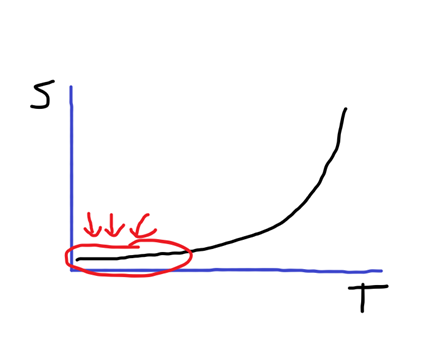

At TCI we routinely talk about savings as a bill you are paying your future self and that time is one of the best assets for investors. We work with you to figure out how much money you’ll need to accomplish your long-term goals and, of course, we’re here to help if any adjustments need to be made along the way. The compounding growth of your savings from investing in the stock market is a wonderful thing, but it also means you do a lot of work early and won’t see the major payoff until later. Effectively, for those of us just setting out to accomplish a goal, we’re in the “flat part” of the curve:

In this masterpiece of a drawing I made, S represents the amount of savings, T is time and the “flat part” of the curve is circled in red.

You don’t necessarily see the fruits of your labor early on. Having been working with clients for over fifteen years now, I’ve been able to see multiple stages of this cycle. I’ve worked with many great savers who were putting money away diligently and seeing some growth, but they can get somewhat frustrated with the perceived lack of progress. When you’re in the moment, it’s easy to wonder when you’ll start to get to the steeper part of your curve, so to speak.

If you’re feeling stuck with your long-term goals, here are a few things I recommend.

1. Talk to your advisor

The relationships we build with clients exist are a judgement free zone. We’re here, objectively, to help you fulfill your financial goals so you can lead a life of financial freedom.

2. Focus on your goals and tune out the noise

We live in a world filled with distractions that are constantly competing for your time, attention and money. Remain focused on your goals and your journey.

3. Breathe

You’ll likely get to your destination, but you must be patient because there is seldomly a reward without a little risk.

The Joy of Fulfilling Long-term Goals

The last few years have marked a nice turning point for many I work with, however. Market growth has been strong, but much more importantly these clients have been saving for over a decade at this point. They are finally starting to see what compounding returns do on a much bigger number! The ultimate point is that the impact of savings you put away today will be hard to see for many years—that’s what makes spending it now so much more appealing to our human nature. As my clients can attest, however, delayed gratification resulting from hard work and an achievement of purpose is so much more satisfying in the end. They are now seeing net worth numbers that seemed far out of reach just several years ago and they are getting to now apply those means to their ends however they’ve defined them.

As for my son, well he was very happy to blow his first week of earnings on a small toy dinosaur he had his eye on. His next goal, however, is going to take at least a month and a half. I expect we’ll see some frustration, but ultimately satisfaction in a job well done when the time finally comes…or he’ll break down and try to steal from his sister’s piggy bank. Either way, a lesson to be learned! Ahh, the joys of parenting.