What to do about Inflation?

The big news this week was a higher-than-expected jump in the month-to-month change in the cost of a basket of goods (which includes energy and housing, which tend to be more volatile)—in other words, the government data officially confirmed what most already suspected, we are starting to see some inflation. Accompanied with a corresponding drop in the S&P 500 of a bit over 2%, financial headline writers couldn’t help themselves but break out the big fonts (I’ll note the Wednesday drop has been entirely erased as I write this—almost like daily price movements are a “random walk” or something). If you read this blog on a consistent basis, you know we should always put our guard up when the pundits start screaming, so with that in mind let’s take a more sober look at the inflation report and figure out what, if anything, can be done with our investments.

Digging Deeper into the Numbers

I am not an economist, but as a writer (of sorts) I do know that I can use economic data to tell any story I want. The numbers are squishy enough and they are revised often enough that what may seem true today might not hold two months from now. Let’s try it. First, the negative spin.

Inflation came in at 0.8% for the month of April, a jump of 400% over expectations. Gasoline prices jumped nearly 50% as supply chain crunches in other commodities like lumber also caused dramatic price increases. Even more worrisome, the producer price index rose 6.2% for the 12 months ending in April. Traders showed their concern that the Fed would soon raise rates to counteract inflation with a sell-off in stocks. Rising bond rates could leave many investors seeking safer fixed income instead of leaving their money to chance in a historically overvalued stock market. Leave no doubt, the days of low inflation are over.

All of those numbers are true. Now let’s try the positive spin.

Inflation came in above expectations for the month of April, but many economists are not concerned. Digging deeper into the numbers, energy prices—notoriously volatile—jumped 25% from the same time last year. Used car sales caused by supply chain disruptions during the pandemic were responsible for nearly a third of the unexpected overall inflation number. Furthermore, year over year numbers are being somewhat distorted by the artificially low starting point of April of last year when the country came to a screeching halt. The Fed maintains they are monitoring but see nothing that would cause them to raise rates anytime soon. The market quickly erased Wednesday’s losses and U.S. stocks remains up nearly 10% for the year. There is cause for optimism in the economy overall as stimulus payments kick in and vaccine distribution reaches the majority of adults.

All of those numbers are true as well. As the old saying goes, economists are very good at explaining what has happened and very bad at predicting what will happen. Predicting inflation, like predicting any future variable, has a history of failure.

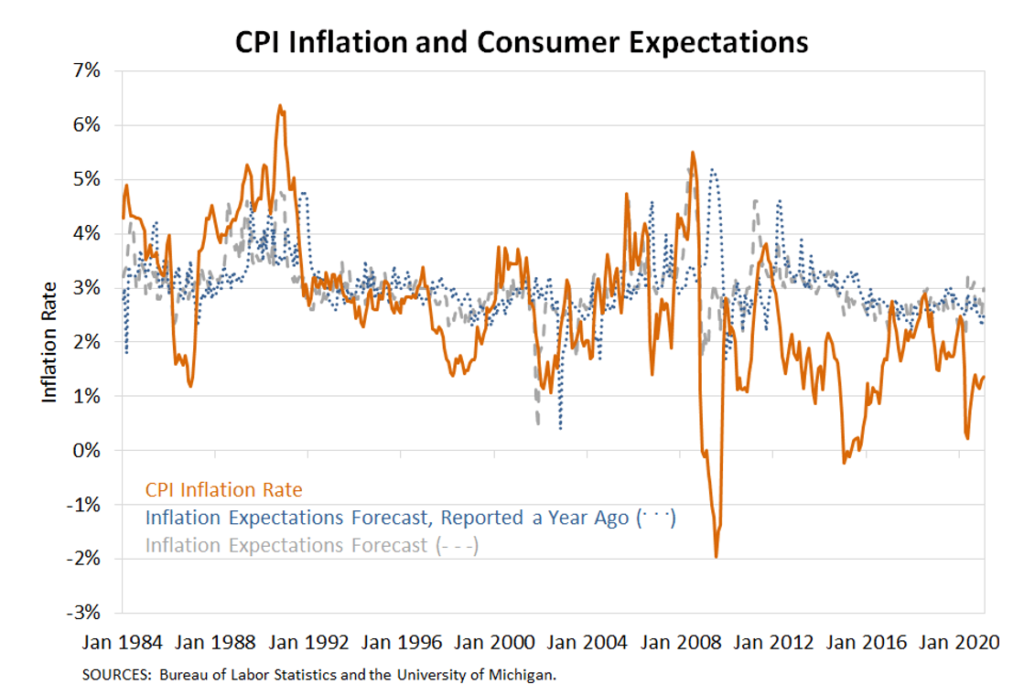

In the graph above, the correlation between the orange line (actual inflation) and the blue line (inflation expectations from a University of Michigan survey) is almost zero. A correlation of zero implies no relationship and no predictive power. What stands out to me is the years following the Great Recession when inflation fears from a greater supply of money never materialized. The late 80s saw the reverse when predictions were relatively stable and consumers were unable to foresee the surprise spike in inflation.

Inflation’s Impact on Market Returns

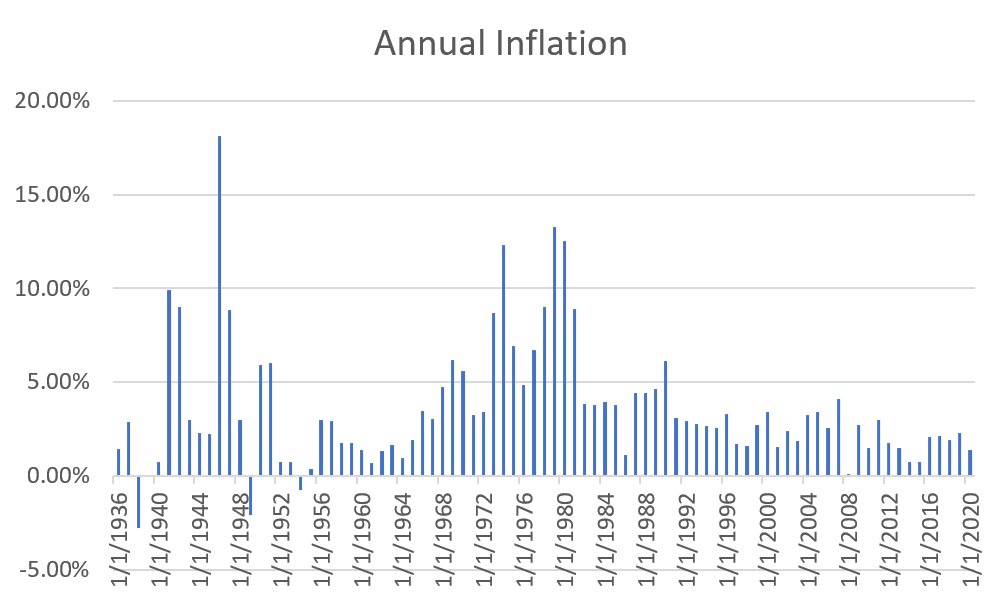

Sustained, high inflation can indeed be a drag on a portfolio in the short-term. We know we can’t successfully predict when that might happen, but it’s important to remember in any case that we are a long way away from that scenario. The only real periods in modern U.S. history that presented that environment were WWII and the early to mid-1970s.

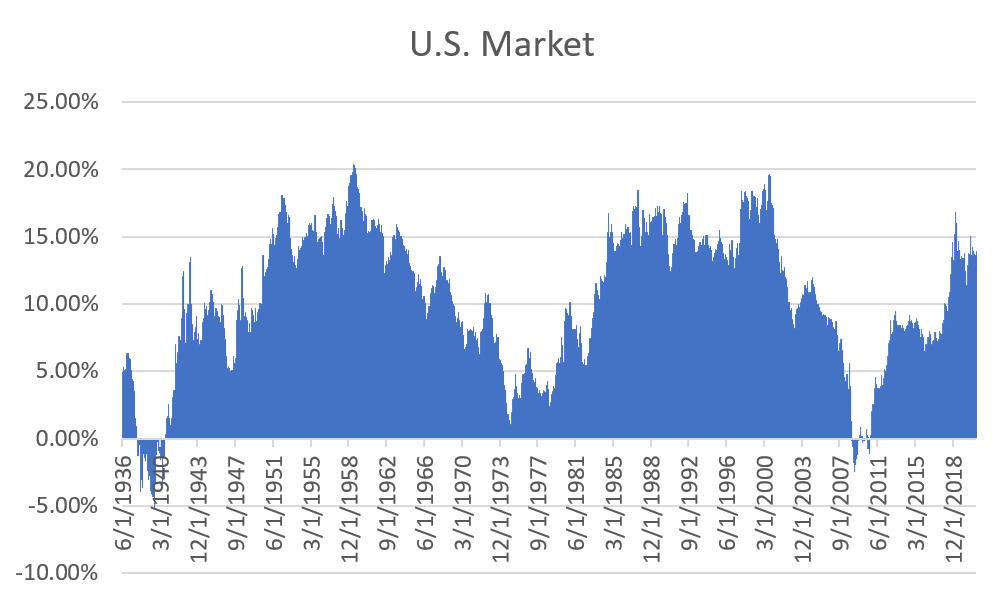

As a comparison point, here are rolling 10-year returns for the US stock market over the same time period:

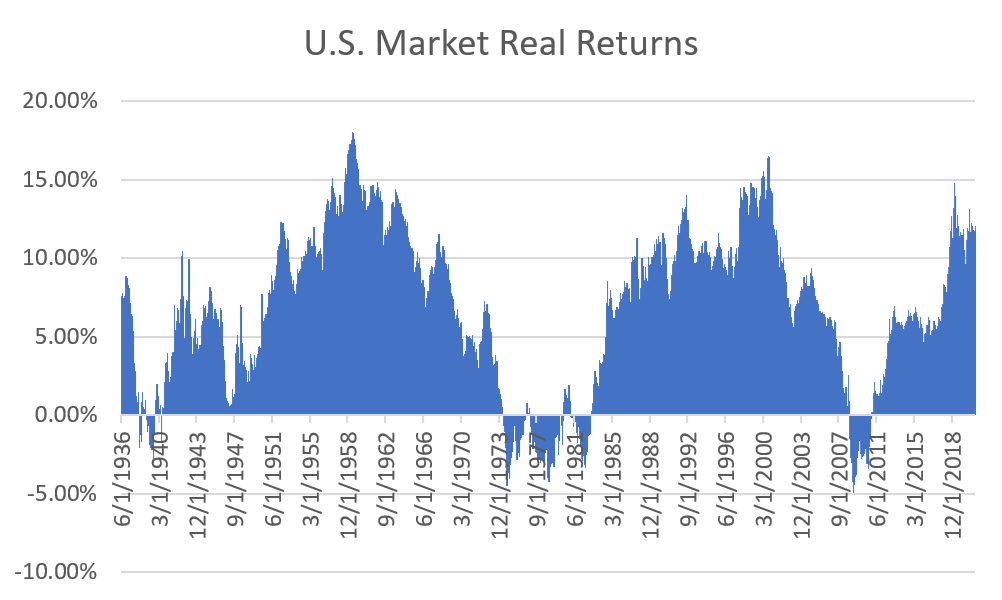

There are very few periods where stocks held for ten years wouldn’t be worth more than they were at the beginning. If we subtract inflation to compute real returns, however, the picture gets murkier.

The same general pattern is there and it’s overwhelmingly likely that we will still have favorable outcomes, but inflation adds a greater measure of uncertainty that we can grow our wealth and increase our purchasing power over time. So, is there anything to do about it?

Trying to Build an Inflation Resistant Portfolio

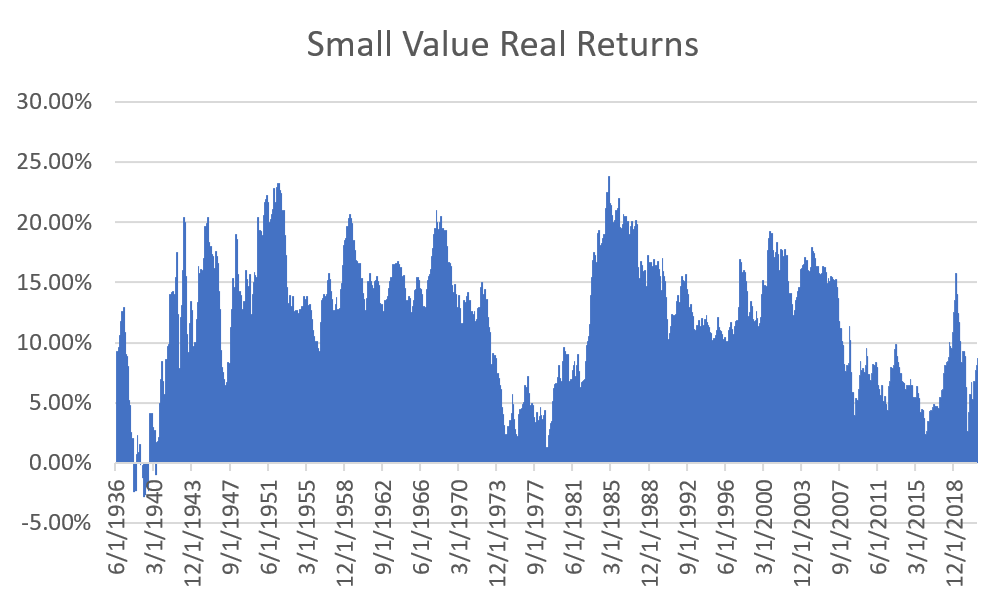

One important factor is that diversification within the U.S. stock market and into International stocks provides some protection. Here, for example, are the real returns (inflation adjusted) of small value stocks over rolling ten-year periods:

Outside of a few short time periods during the Great Depression, small value stocks have managed positive real returns over any ten-year time period.

The other major part of most portfolios is fixed income. One way to counteract rising inflation is to hold relatively short-term fixed income positions. As inflation rises, there is often a corresponding rise in interest rates. By holding short-term securities, we are able to turn over the positions more frequently and reinvest into higher interest replacements. The relationship is not perfect but it’s one of the best protections we have with a correlation of about 0.45 (a correlation of 1.0 means two things move perfectly in sync while a correlation of 0 means they have no relationship). Long-term fixed income and stocks actually have very small negative correlations in the short-term. Gold has a correlation of 0.11 and commodities more broadly have a correlation of 0.25 which is to say there is not nearly as strong of a relationship as is implied by the conventional wisdom.

You may have a unique enough situation where even more inflation protection is warranted. There is one good option out there, Treasury Inflation-Protected Securities (TIPS), which is linked to inflation and thus, highly correlated. There are other risks associated with those securities, so it’s important to talk to your advisor about whether that may be warranted.

The good news is that your portfolio already utilizes diversification across stock asset classes and holds primarily shorter-term fixed income. Perhaps this is unsurprising. After all, a good long-term allocation has to be robust enough to hold up to many economic environments—recessions, booms, high inflation, low inflation, etc. The bottom line is that inflation is always something we are monitoring, but this month’s data does not warrant any major action in portfolios.