ETFs vs. Mutual Funds: Which Should I Own?

This is a question we’ve been fielding for at least a decade now as Exchange Traded Funds (ETFs) have risen in popularity and quantity (over 7,500 globally!). They are as widely available as mutual funds now and are much more frequently advertised. To a long-term investor, however, the differences between an ETF and an index mutual fund are largely irrelevant. If you’d like to stop reading here, I won’t blame you.

Largely irrelevant, however, doesn’t mean it’s completely irrelevant. Improving a portfolio by 10-15 basis points (0.10-0.15%) can be material when taken out over a long time period. So, for those of you that want more details, we shall forge on.

ETFs and Mutual Funds are Investment Vehicles, not Asset Classes

It’s important to remember that we are talking about differences in the mechanics of investing vehicles, not differences in the underlying investments. An S&P 500 ETF and an S&P 500 mutual fund are going to hold the same stocks, so the differences come down to how they trade.

For our purposes here, when I refer to mutual funds I mean “open-ended mutual funds” and when I refer to ETFs I mean “exchange-traded open-end ETFs.” There are closed-end mutual funds, unit investment trusts, and exchange-traded notes that are all outside the scope of what matters to us in this discussion.

When we purchase a mutual fund, we are actually purchasing shares from the fund company. There is no limit on the amount of shares a fund company can create and it is largely based on demand. Each time a new buyer makes a purchase, more shares are created. Mutual funds price at the end of each trading day and at no other time. Though the underlying stocks are definitely fluctuating in price throughout the trading day, any mutual fund purchase will “settle” at the end of the day and everyone will get the same end of day price whether they were buying or selling. If more money came in then went out, the fund manager will go buy more stock however they see fit. If more money goes out then came in, the fund manager may have to sell some of their holdings to free up cash for the sellers.

An ETF is different in a few key respects. It is a basket of securities where shares are created or redeemed in large quantities by institutional investors. Anyone can purchase shares in the basket of securities. Due to this difference, ETFs price throughout the day just like their underlying stock positions. That means that when we purchase an ETF during the day will affect the price. Constant pricing also allows for short-selling. Both of these features are not helpful to us as long-term investors, but there is one that is.

Since we are purchasing a basket of securities instead of mutual fund shares, there is a tax advantage to the ETF. Any capital gains can typically be deferred for a very long time in an ETF, whereas a mutual fund may have capital gains distributed at the end of a year that the investor doesn’t have control over. When compared to a very actively traded mutual fund, this can be a major advantage, but it is diminished quite a bit when compared to a passively traded index or tax-managed fund. ETFs may come with cheaper expense ratios and cheaper transaction costs as well.

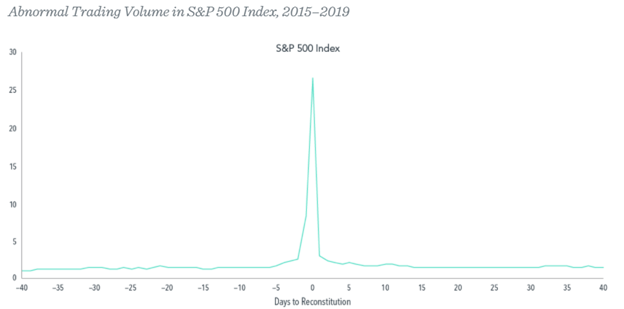

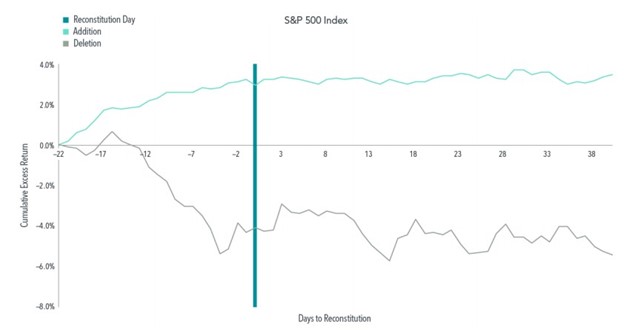

The other major difference is that until recently, ETFs were mandated to maintain a pro-rata use for creations and redemptions of shares. That effectively forced ETFs to be pure index funds. Now, pure index funds are great, but they don’t allow for a flexible trading approach, among other issues, that can add value over time. Take the example of Tesla entering the S&P 500 Index recently. There is good evidence that the trading volume on stocks entering or leaving the S&P 500 increases significantly around the day of reconstitution (when the index officially changes components).

An index ETF (or index mutual fund) has a primary goal to limit tracking error and is forced to trade around this time period. That can often lead to negative effects on a portfolio’s return as the priority becomes immediacy instead of consistent asset class exposure. These effects are minimal for any given example, but can become significant over time and many instances.

So that was the bottom line for a long time: ETFs made a lot of interesting trading advances, but many of those functions were irrelevant to us as long-term investors and we gave up the value-add of flexible trading by adhering to the rigid structure and mechanics of the ETF.

New SEC Rules

The SEC recently adopted rule 6c-11 (I know you were all eagerly following this news) that allowed for a change in ETF structure. This had the negative consequence, in my mind, of opening up the ETF world to active management. As investors, we now need to be more careful about just assuming any ETF is an index fund. However, it also had the positive consequence of allowing thoughtful fund companies to use the new rule to apply a more flexible trading approach to the ETF structure. Since the rule was adopted in 2019, many new products have hit the market that adhere to an evidence-based investment philosophy. Wading through them all is a good problem to have.

Implementing a Portfolio

Like always, TCI’s research starts from the top down. In other words, what does the evidence say is the proper allocation amongst asset classes? Are there certain groups of stocks that should be overweighted relative to the market? Once we have those figured out, then it’s a matter of finding the best product to implement that allocation. If a mutual fund and an ETF are applying the same investment principles, then it may make sense to lean towards the ETF for its lower transaction costs and slightly improved tax efficiency. There are trading issues that may make those lower costs moot (I’ll spare you the details, but an ETF can actually trade at a price different from the value of the underlying basket), but it’s worth exploring.

Even with the rule change the bottom line is that whether we end up using a mutual fund or an ETF is relatively low on the list of priorities. Nevertheless, it’s a decision that can make a difference over the long-term. TCI will always strive to implement the portfolios in the best way possible and it is quite likely ETFs become a bigger part of that than they have before.