With the presidential election fast approaching, emotions are running high, and you may be thinking about the potential for market volatility affecting your investment portfolio. However, a careful review of presidential election history and its impact on the economy and financial markets suggests that remaining calm may be the most appropriate investment advice. Here’s why:

If you listen to the pundits, there’s always something to worry about when it comes to your money. After all, emotions and money are joined at the hip. However, every four years, presidential elections ratchet up emotions to a whole new level. This is especially true in tight elections, like the one we’re currently experiencing.

It’s okay to feel these emotions. We all do, myself included. The loud and unforgiving 24/7 news cycle doesn’t help, but that doesn’t mean that we should let politics and emotions impact our financial journey. Politics and the economy are two very different things. The evidence indicates that it likely will not pay to make long-term investment decisions based on who might or might not win an election.

Economists point to the theory of behavioral finance, which describes how psychological influences and biases can lead to irrational decisions and actions, such as panic selling in the market or overspending on credit cards. The emotions that come into play around presidential elections, fueled by social pressure and instinctual reactions, can create both serious fears and false optimism, neither of which is a great foundation for making important financial decisions.

A big part of our job as financial advisors is to strip out the emotions, the behavioral piece, from your decision making. At the same time, we are here to be your sounding board and help you manage emotions as they relate to your financial journey.

For us, there are more important questions than who will win the election. What are your goals? Is your plan still on point? Is its performance on track? Are we following the data? And what does the data say? These are some of the important questions to explore.

What does the data tell us about market returns and presidential elections?

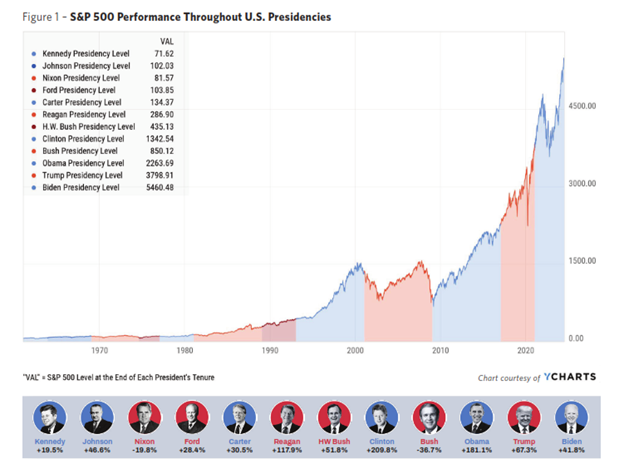

Figure 1 takes us back to 1960 and shows the performance of a $10,000 investment in the S&P 500 over the course of 15 presidential elections and the administrations that followed.

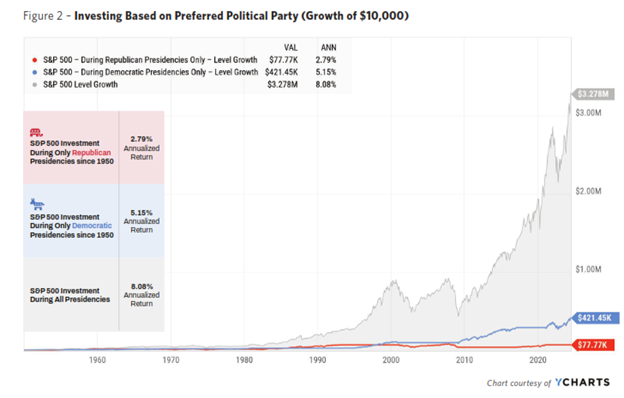

Figure 2 illustrates what would happen if you had invested in the S&P 500 index only during Republican administrations. Since 1961, a $10,000 investment, with an annualized return of 2.79%, would have grown to $77,770 by 2023.

If you had remained invested in the same index only during Democratic administrations over the same period, with an annualized return of 5.15%, your portfolio would have earned $421,450.

Depending on your perspective, neither 2.79% nor 5.15% may be particularly attractive.

But if you had maintained your investment in the S&P 500 index during all presidencies, both Republican and Democratic, over the same time period with an 8.08% annualized return, your $10,000 would have grown to $3,278,000.

A U.S. president is like the manager of a baseball team.

In baseball, managers make decisions that impact the game, but rarely do they make decisions that win or lose the game. It’s the nine players on the field and their combined performances that ultimately decide the outcome.

In the S&P 500 and other major indices, it’s the companies that drive market returns – innovating, producing new products, growing earnings, and returning revenues to shareholders. The U.S. president has very little to do with all of that for any given company.

Then there’s the old business of trying to time the market.

How would your portfolio have performed if you missed some of the market’s best days? Many times, the best days in the market follow some of the worst.

Hopping in and out of the market because of election fear is like rolling the dice. Maybe you miss a bad day. Maybe you miss a bounce. People have been trying to figure this out for years. Trying to time the market is a fool’s game; I haven’t met anyone who’s been able to do it.

There will always be worries around elections and market returns, but there are also reasons to be calm.

With 34 years of experience, we’ve seen how this works over the course of eight presidential election cycles, and our message to clients has always been the same:

Stay the course. Don’t make decisions purely on emotions.

Seek guidance from the financial plan we’re creating together. Pay attention to the data. Benefit through diversification, risk mitigation and compounding. Be mindful of your risk tolerance; stay focused on your goals and objectives.

Remember that we’re always here for you, to listen, to reassure, to reassess if necessary and to help you stay on course.

In the meantime, be sure to vote.