Controlling our Cognitive Biases

It feels like just yesterday that we restarted these weekly posts back in the initial days of the pandemic. Over that time my son has started attending kindergarten both virtually and now in person. My daughter has grown from “the cutest toddler in the world” to “the cutest toddler in the world with an attitude.” We’ve all adapted to a constant routine of Zoom meetings, mask wearing, social distancing, and the realization that we were never washing our hands well enough prior to all of this. Basically, our world pre-2020 was a lifetime ago. On top of all that, it’s been a volatile week in the markets and this is our last official communication before the “most important election in our lifetime.”™

So what to talk about?

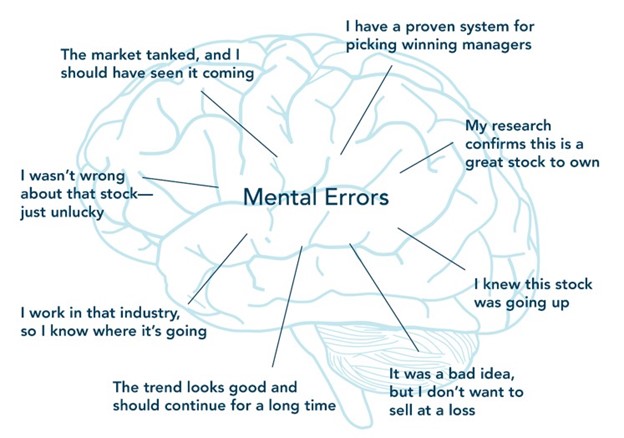

Well we’ve covered the impact of presidential elections on markets (CliffsNotes version: it’s overrated). We’ve covered what to do in the face of volatile markets (CliffsNotes version: stay disciplined). So, I thought we’d dive a bit deeper into our own cognitive biases. In the face of a world where we are bombarded with information over which we have little influence, let’s remind ourselves of how our emotions and biases can drive our decision making. Our natural instincts have served us well as a species when it comes to survival and growth, but when it comes to investing those same natural instincts lead to faulty reasoning. Being aware of these inherent biases is the first step to making sure they don’t negatively affect us.

Overconfidence

Familiarity

It’s often an option that you can invest 401(k) savings in your company’s stock. This is a terrible idea in that the majority of your financial future is already tied up in your company by nature of working there. The urge to put a significant portion of your savings into your company stock stems from this familiarity bias—the idea that we’re far more comfortable investing in something we know, even though that may lead to being undiversified. Familiarity is what may also lead us to invest solely in large companies we feel comfortable with or perhaps be overconcentrated in our home country. There is a world of investment opportunities out there and at our fingertips. Don’t let the familiarity bias lead to a lack of diversification.

Attribution

This comes in two forms: self-attribution and outside attribution. The self-attribution bias is simply giving oneself credit when things go well and blaming outside forces when things go poorly. I probably don’t have to tell you this bias isn’t just specific to finance. Self-attribution is often a gateway to overconfidence as well. Outside attribution happens daily when it comes to investment headlines. Any time an election is on the horizon, this attribution bias comes to the forefront. Every market movement is seen through the lens of shifting poll numbers for one candidate or the other when the reality is that markets move for thousands of reasons every day. There’s also the sense that markets get more volatile when elections approach though there’s little evidence of this. We tend to get so wrapped up in our political emotions that we don’t realize markets are always volatile. It’s false attribution to assume that they are behaving because of one specific variable.

Recency

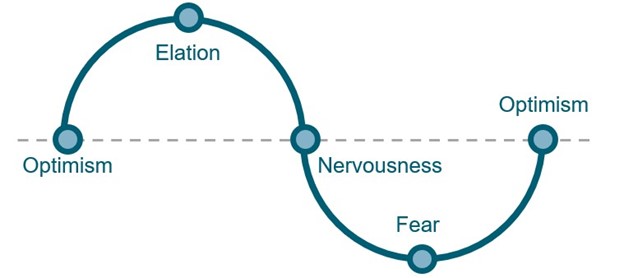

This describes the tendency for investors to rely on short-term historical data in determining their portfolio. It’s also the basis for what we call the Emotional Cycle of Investing.

Markets move up and down all the time, but they have a consistent upward trend given longer cycles. A few months of a good or bad market does not overturn 100 years of evidence.

Herding

Somewhat related to the fear of missing out, this bias leads to buying high and selling low over time. Many investors in a well-diversified portfolio were tired of watching their neighbors do so much better in tech stocks during the late 90’s so they bought just in time for the crash (sounds a bit familiar to current times). The idea that “everyone was doing it” led to a poor investment decision. The same can be said of panic selling during market crashes.

Awareness is the Answer

All of the aforementioned biases are born out of natural human instincts and a world of influences around us, so there’s no need to feel ashamed if you recognize they’ve affected you. Quite the contrary! A few hundred years ago we might have known quite a bit about our neighbors and the area we lived, but we rarely got any information about the greater world, and it certainly wasn’t timely. That was generally good enough to pursue happiness in our own spot on the world. However, the amount and speed of information has obviously changed dramatically.

That is why I wanted to touch on these biases this week, we have been in a hyperaware state of being for some time. We know more about the world than ever before which is a good thing overall, in my opinion, but it’s not all good. We also get a lot more bad information that we can’t do anything about. We can feel the pain of someone half a world away while having little to no influence over improving the state of affairs immediately. It can certainly lead to a feeling of powerlessness. One thought that I would argue, however, is that you can properly use all this extra information to make yourself more powerful over controlling your own world and pursuit of happiness.

The constant bombardment for your attention can be overwhelming. I encourage you to step back and make sure your pursuit of happiness is in focus, especially as the election approaches. If you’re one of those that has managed to tune out the news lately, give yourself a huge pat on the back. Your natural instinct is telling you to react and respond to everything around you and that’s okay. Acknowledging biases that are thrust upon you from outside sources and being aware of their effect diminishes their power and frees you to make better decisions.