Living with an Abundance Mindset

At TCI, we have six well-defined core values that shape our culture, influence how we hire and with whom we work. Together the six values align to create an incredible tool that allows us to fulfill our mission of empowering purpose-filled lives for our clients. One of those values, in particular, stands out to me as exceptionally unique, abundance. We define it as follows:

“At TCI, we lead with thoughts of abundance, not scarcity. We share our time and resources so we can contribute, celebrate, and share in each other’s successes.”

In other words, life is not a zero-sum game. Someone doesn’t have to “lose” for someone else to “win.”

I’ve been thinking about this a lot in conversations with clients recently. Many clients are realizing that they are tremendously well-positioned to likely achieve their goals. Old, young, nearing retirement, it doesn’t matter. Across the board most TCI clients have high confidence they are on the right track. Most of this is due to them concentrating on what they can control—primarily savings and spending—but certainly the last several years of above average market returns have been beneficial. By staying focused on the things that matter and participating in capital markets, they have created their own sort of abundance.

Having high confidence that we are on track to reach our goals puts us in an exciting position. If we’re fairly set on getting to our destination, we might wonder how much further we can go? By leaning into abundance, many of us have created a surplus above and beyond the life we’ve so far defined.

Quantifying How Much Is Enough

First, of course, it’s worth quantifying how much it is you need to achieve your goals. I find many people have a number in their head (“if I just had $2 million…”), but don’t have the necessary context. What makes you think you need $2 million? What if you don’t need that much? What if you need more? Fortunately, we have tools that make this relatively easy to figure out.

The first step is to broadly define what you are trying to accomplish. How much do you need to live on to support your lifestyle? Do you have a goal to leave a legacy to family or charitable causes? How much short-term volatility are you willing—or do you need—to take on to give you the best chance at meeting those goals? We can then model the uncertainty in future stock returns to arrive at an answer for “the number” you need to have confidence those goals will be achievable.

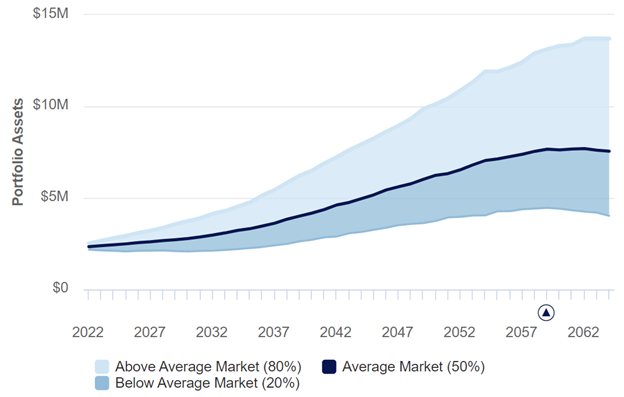

Here’s an example of a hypothetical couple I’ve created. They are starting with about $2.5 million in assets across various accounts as they enter retirement. The projection you see below shows how those assets may be expected to grow in an “average” market, an “above average” market, and a “below average market” given the couple’s spending needs.

In this example, you can see that even in a “below average” market over their lifetime, they can still expect their portfolio to support their needs and even grow over time. They can be highly confident that $2.5 million is plenty for their goals as they’ve defined them.

Quantifying a Surplus

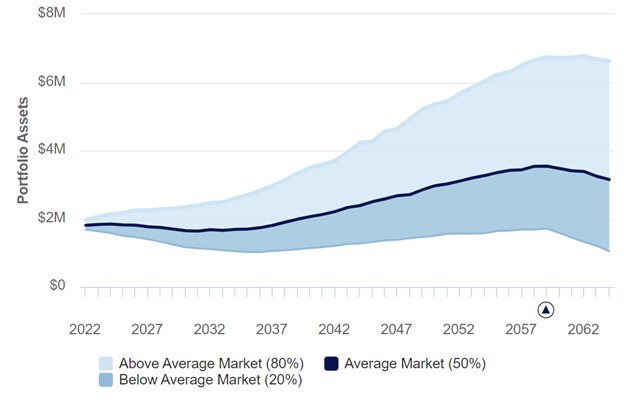

In fact, $2.5 million today is likely to leave them a surplus when they eventually pass. They have more than they need and we have the ability to quantify how much more. By removing $500,000 out of their current total and effectively beginning with just $2 million, we get the following results.

You can see that it’s still very likely this portfolio can support the couple’s needs and, in many cases continue to grow. Even in a below average market for the rest of their lives, they can be confident their needs will be met. As of today, they effectively have at least a $500,000 surplus.

How to Handle a Surplus

What is interesting to me is that the old model of planning would often leave this surplus out of the discussion. The assumption was that a surplus was something to be addressed at the end of life, typically in the form of who ends up inheriting that excess. While that thinking may create a warm feeling of safety, it underestimates the impact that people can have with their projected surplus today!

There is a cost to waiting until the end. Perhaps there were times when a family member had a financial need that went unmet (say a down payment on a child’s first home) or experiences that never happened. Perhaps an increased charitable impact today instead of thirty years from now inspires some. Perhaps some simply want a higher standard of living than they’ve defined. Any of those answers are great, but the point is, “why wait?” If we can have a high level of confidence that we have a surplus, then let’s be intentional about that today!

The exponential impact our money can have today—to ourselves, to our family, to our community—is always more valuable than the uncertainty of what may be there in the future. I encourage you to work with your advisor and use the tools we have at our disposal to quantify these things. What do you need and what might you be able to achieve with the “extra?” That’s living with an abundance mindset.