A Scary Story: War of the Worlds Comes to New Jersey

It’s late into the evening on October 30, 1938, and you’ve just finished carving three jack-o’-lanterns in anticipation of the neighborhood Trick-or-Treat festivities tomorrow night. They look good and scary on your front doorstep. Princeton, New Jersey takes their Halloween seriously, and you are excited to have some fun with friends and neighbors. The fall breeze has a little more chill in it than last week, and a harsh gust of wind bites at your nose and ears as you make your way inside and settle down next to the radio with some hot tea. It’s just past 8:00p.m., so you turn on the radio for a little evening entertainment before bedtime. The local CBS station is producing what sounds to be a live, breaking news report, and you sit back in your chair to listen.

The news host is going on about an abstract object falling out of the sky and onto a farm over in Governor’s Mill. The reports of police and a crowd peak your attention, but things start to get strange when the news host becomes animated and begins to describe an extraterrestrial appearing from within the otherworldly object and shooting at the crowd with a laser beam.

What is going on?

As you put your tea on the table and scoot to the front edge of your chair in order to lean in a little closer to the radio’s speaker, the reports begin to come in of an alien attack on New York City?

Can this really be happening?

Aliens? New York City under attack? This can’t be happening!

New York is fifty miles away! What if they come this way next? What do we do…?

— — —

History Helps Us to Make Sense of Our Future

That really happened. Not the alien invasion, but the live news broadcast and the ensuing panic. The news broadcast itself was not real. Rather, it was a dramatized radio adaptation of H.G. Wells’s The War of the Worlds, a science fiction novel about a Martian invasion first published in 1897 and produced for radio that night by a struggling Mercury Theatre on the Air. Orson Wells became famous — and infamous — for his leading role. In an effort to make the entire show more dramatic, producers scripted it in the format of a news broadcast. That hadn’t really been done before, so listeners believed what they were hearing and bought into the story. Naturally, many people panicked, and there would be fallout for years to come.

The event has gone down in infamy and stands as a stark example of the very real effect that entertainment and news media (are those two really different?) can have on the real world. The stock market is no exception. In fact, network and cable news, social media, and even local newspapers impact investor behavior to a very real degree. Every day, tens of millions of people tune into Mad Money to hear Jim Cramer’s latest predictions or Squawk Box for updates from Fortune 500 CEO’s. Columns in the New York Times, Wall Street Journal, and USA Today predict the next winners and losers. Consumers then sign into their online brokerage platform or call up their broker and act on the information that they just heard or read.

This is called the Media Effect. It is a well-known variable in behavioral economics that speaks to the influence that media plays in investor behavior, market movements, and economic policy. It’s a major topic of consequence. Harvard Law School even hosted its own conference in 2019 titled Social Media and Behavioral Economics, where they invited media experts for Facebook, Twitter, SocialFlow, and Microsoft.

The Impact of Media on Financial Markets

The consequences of media hype on financial markets is well-documented. There is a robust body of research that captures the profound effects of various mediums on the stock market and investor behavior. Researchers have even started to use the output from the news cycle to predict next day and short-term market movement. For example, a study conducted by the World Bank, International Monetary Fund, New York University, and the University of Southern California found that optimistic news coverage predicts an increase in market returns, and coverage that tilts towards a negative sentiment lead to short-term market drops (Media Sentiment and International Asset Prices).

The effects are not just on the national level, but local media carries significant weight as well. A study in the Journal of Finance found that local media coverage strongly predicts trading levels within the local coverage area (The Causal Impact of Media on Financial Markets).

All of this is explained by Nobel Prize winner, Robert J. Shiller in his book, Irrational Exuberance: “Significant market events generally occur only if there is similar thinking among large groups of people, and the news media are essential vehicles for the spread of ideas.”

The Media Impacts Market Outcomes

So what does all of this mean? Very simple. The media impacts market outcomes. Read that again. The proof is out there. Media pundits and “market experts” are not predicting market behavior, they are causing it.

It makes sense. When you have headlines that read “Analyst who called April stock market rally says watch for this level” and “Goldman Sachs predicts over 40% rally for these 3 stocks”, people are naturally going to take action. The headlines are written in active style with an implicit call to action. And the market doesn’t move on its own. Participants have to be present in order to move prices in either direction. Have you ever noticed how the media experts always tell you when or what to buy but never say how long you should hold that stock for or when to sell it? The recent Apple split is a perfect example. The media coverage was tremendous, and everyone wanted to buy Apple. All of the experts said to buy Apple. Pretty easy to predict that a lot of people were going to buy Apple. Impossible to say when they were going to start selling it. The surge from the Apple split lasted about a day. The price jumped past $134 the day after the split and then went into a steady decline to $108 three weeks later. Buying Apple at the split was not a great time to buy Apple. Or rather, selling Apple the day after the split was a great time to sell Apple. Did the media experts tell you that? No, they did not.

If you listened to the War of the Worlds broadcast today, you likely would not be duped like the audience in 1938. We know better. But do we really? “No one involved with War of the Worlds expected to deceive any listeners, because they all found the story too silly and improbable to ever be taken seriously. The Mercury’s desperate attempts to make the show seem halfway believable succeeded, almost by accident, far beyond even their wildest expectations” (Smithsonian Magazine, The Infamous “War of the Worlds” Radio Broadcast Was a Magnificent Fluke).

We know that there is a lot of knowledge and legitimate information that can be attained from watching news channels, but we also know that media outlets are business — big business — and they make money by drawing in large audiences, and must therefor make their shows entertaining. So where is the line between real information and entertainment? And do producers, reporters, and news hosts today expect us to know where that line is? Whether we are expected to know or not, history tells us that we just don’t know.

So what is the take away here? The answer is tune out the media, or if you can’t do that, then to do nothing when prompted. Ignore the media and know that Living in the Present… Effectively is not only better for your well-being, it’s also better for your portfolio (check out Sam’s article).

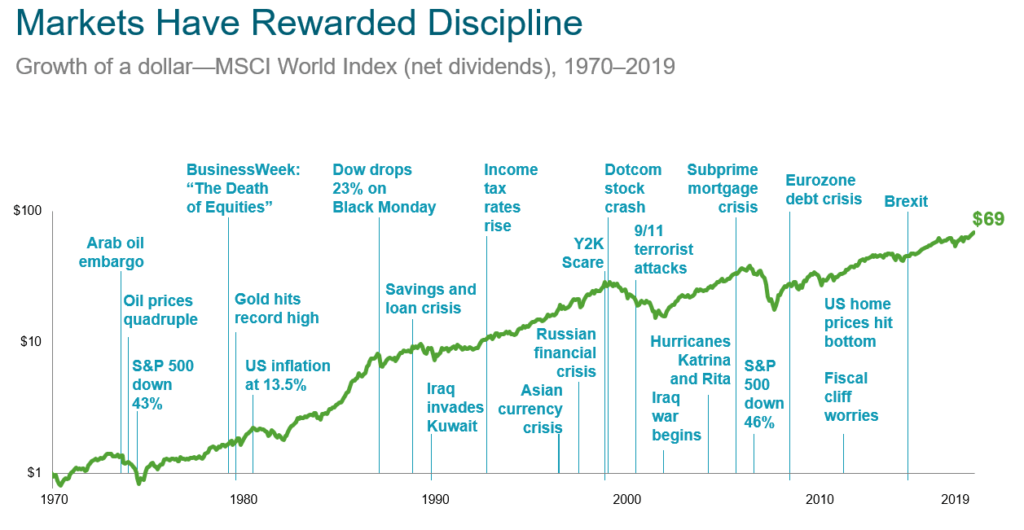

This just in… we can now confirm that a long-term, disciplined approach is an effective way to sound investing and a successful financial plan.

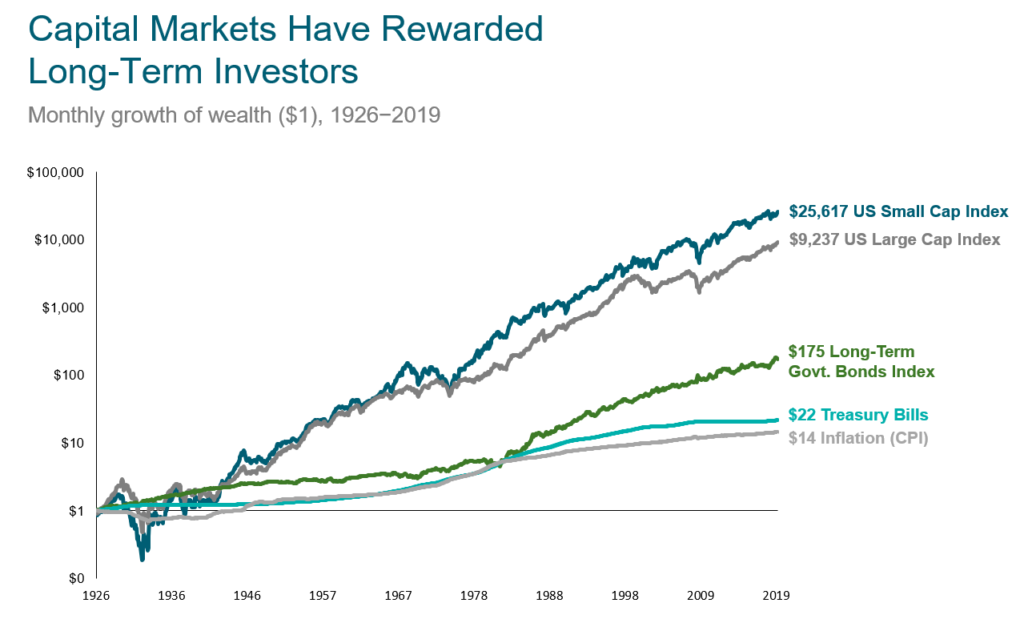

I’m going to make a bold prediction… The market is going to experience short-term volatility and continue to grow along with the economy over the next 10, 20, 30+ years. The following two charts from Dimensional are the source of this courageous forecast.

If you were going to act on anything that you read today, act on that. Although if you already have a disciplined and long-term financial plan, then no action needed.