After three great years for market returns, 2022 has gotten off to an unexpected start in the first couple of weeks. The S&P 500 Index is down 4%, as of this writing, from its peak at the beginning of the year. This is just short-term noise and in line with normal market volatility, of course, but a volatile start to a market year changes our perception. Our year-to-date market numbers are showing a down arrow and we haven’t seen one of those in a long time! In fact, the second half of last year produced multiple weeks like we’ve just seen, but it was far less noticeable when our portfolio was already up double digits.

As is often the case, the financial press needs something new to talk about, so the added volatility leads to heightened talk of a market correction (officially defined as a 10% drop from the peak) being inevitable. A market correction is inevitable, of course, but the implication from the pundits is that it is imminent. Those are two very different things. Imminent instills a notion of fear and that some sort of action is required. Yet, the data tells us that responding to this noise isn’t in our best long-term interest because trying to time the market is a fools errand. Inevitable let’s us somewhat anticipate these hiccups in the market so we’re able to structure our portfolios in a way that offers some protection against these market downturns.

To keep a proper perspective, let’s revisit a few key topics as we head further into 2022.

Do January’s Results Impact the Whole Year?

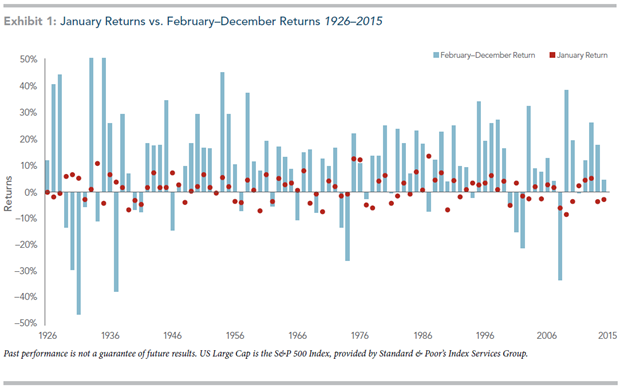

You may have heard the old stock phrase, “As January goes, so goes the rest of the year…” when it comes to stock market returns. Similar to “Sell in May and go away,” this turns out to be conventional wisdom that isn’t all that wise.

This chart is a few years old, but after updating for the last several years, the relationships hold. Going back to 1926, January has been in the red 37 times—given that there have been 95 Januarys, 38% have had negative returns which is right in line with the 36% of all months that have negative returns. Following those negative January’s, the subsequent eleven months have resulted in positive returns 62% of the time. The last two years, in fact, have had negative January’s followed by spectacular returns the rest of the year–including the March 2020 COVID crash!

There is nothing special about January returns that can tell us about the rest of the year.

The Frequency of Market Corrections

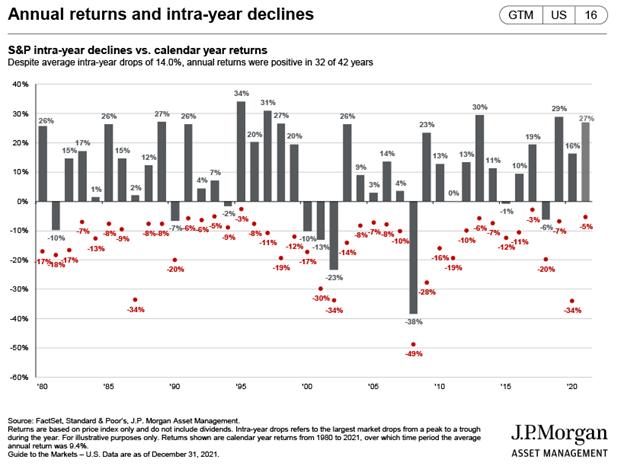

On average, a decline of 10% in the S&P 500 happens about once every year if we go back through history. Now, some of those are concentrated in specific time periods and it’s quite possible to go years without one, but the point is that significant drops are a lot more common than one might think. One of my favorite charts (created by J.P. Morgan’s research department) shows the calendar year return of the S&P 500 contrasted with the largest intra-year peak-to-trough decline:

Declines happen frequently—that’s volatility!—and yet the market has been positive in 32 of the last 42 years. What is also interesting from this chart is how quickly markets can adjust. The years 2009 and 2020 stand out in recent history as having high annual returns with major drops in the middle of them.

How to Weather a Market Correction

Don’t do anything different than what we always do. Prediction of short-term market movements is folly. As Paul Samuelson, a Nobel prize winner in economics, famously said, “the stock market has forecast nine of the last five recessions.” Recognizing we can’t know the immediate future, however, doesn’t mean we can’t be prepared.

As pointed out above, recoveries can happen fast. Our focus should not be on avoidance of a downturn, but rather on how we take advantage of any downturn to make us stronger for the inevitable recovery. A disciplined rebalance strategy will help us buy low and sell high more often than not by keeping the focus on a consistent risk profile in our portfolios. Tax-loss harvesting, when appropriate, can smooth out and lessen our tax burden over time resulting in a greater after-tax net worth.

The future of the stock market is uncertain. The reasons for that uncertainty change with time, but the fundamental risks—and the long-term returns from a disciplined investment strategy that accepts that risk—remain.