Revisiting Our Most Popular Blogs of 2021

Whether it’s sharing observations on topics relevant to your financial well-being or providing insight on our investment philosophy, nearly every week TCI blog authors strive to empower and educate our readers. As the year winds down, this week we thought we would look back by providing updates to our most popular blogs from 2021. Want to revisit the original blogs? They can be accessed by clicking the buttons.

#3 What You Should Know About SDGs and Sustainable Investing

Since the blog was originally written, the momentum behind sustainable investing continues to grow. According to the Forum for Sustainable and Responsible Investments, “The total US-domiciled assets under management using sustainable investing strategies grew from $12.0 trillion at the start of 2018 to $17.1 trillion at the start of 2020, an increase of 42 percent. This is 33 percent – or 1 in 3 dollars – of the total US assets under professional management.” It’s clear that we aren’t the only ones asking for sustainable options. The increased interest investors have to use their assets to promote a more sustainable future is apparent.

As of this writing, I’m also watching progress on the United Nations 2021 Climate Change Conference – seems timely as United Nations member states adopted the SDGs back in 2016. There are encouraging signs we’re slowly getting on the right track but I continue to hope for more progress, commitment and unified effort to combat climate change and work toward the SDGs in 2022!

#2 What to do about Inflation?

Since I wrote this article earlier in May, we’ve had renewed (and continued) inflation concerns. Good faith economists are still debating whether the latest report is a sign that inflation is here to stay or whether this is a temporary jump due to pandemic related supply chain issues—no one defines how long “temporary” is.

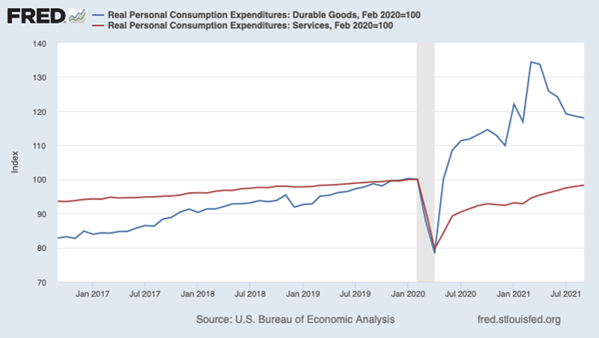

As I pointed out in the original article, you tell me your conclusion and I can find you the data to support it. On the side of “this is temporary,” much of the recent inflation numbers are directly related to a demand for goods outpacing the ability to supply those goods, as seen in the chart below. We had an economy trending towards services as a replacement for goods prior to COVID, and now there has been a sharp reverse (think of canceling your gym membership and buying a treadmill instead):

Might that even back out once the supply chain blockages are cleared? Time will tell.

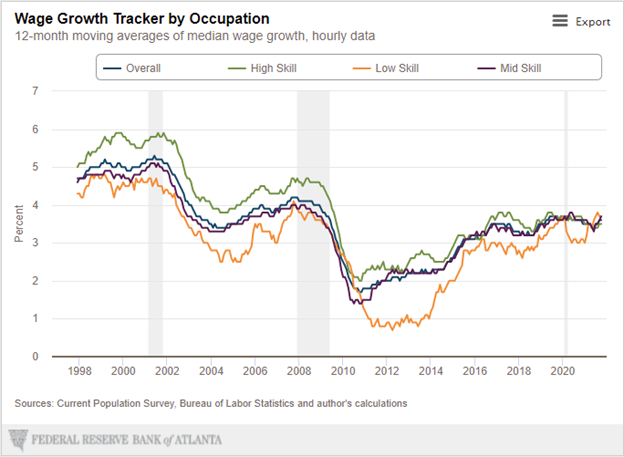

On the side of “this is more permanent,” we are starting to see some wage gains, illustrated in the chart below, particularly among lower skilled jobs (think of restaurants raising wages to attract people back to work).

Could we see something like a wage/price spiral (prices are going up, employees demand higher wages, employers pass through higher costs in prices, repeat) in the future? Time will tell. As I had mentioned in the original, economics is good at explaining what has happened and not as good at predicting the future.

Of course, the main point to the article still holds—a portfolio that holds a combination of diversified stocks and relatively short-term fixed income is the best protection against short and long-term inflation. Inflation continues to be one of many risks we face as an investor…and one of many risks that results in long-term expected returns for our portfolio.

#1 YOLO vs. FOMO: You Don’t Have to Choose Between Living Life Now and Being Prepared for Retirement Later—in Fact, You Shouldn’t

While in the original blog I vowed never to mention YOLO or FOMO again, it’s gratifying to revisit this topic because it means that people found their way to the article. That being said, there isn’t much to update on the original blog post itself because the intent of the message is to represent a mindset that we are trying to instill with everyone we meet with at TCI. Our goal is to help you get to a point of comfort with your daily expenses (planned or unexpected) that won’t impact your financial future.

However, there is one thing that I want to comment on which picked up steam after the blog was sent out, The Great Resignation. In large part due to the existential questions brought on by the pandemic, people around the world have been leaving their jobs for numerous reasons. While the effects of these resignations can be felt within the economy, I fully embrace people leaving their positions because they are unhappy at work, want to go back to school, need a breather or any other reason they see fit. These actions definitely play into the YOLO mindset. Yet, I can’t help but hope that most people are making these decisions with their finances in mind. The people fueling The Great Resignation are between the ages of 30 and 45 years old. Their potential loss of income at the beginning of their prime earning years could lead to an impact in their finances and some FOMO down the line when their peers achieve financial freedom.