One year.

One year that alternately felt like it lasted ten years and two weeks simultaneously.

They tell you when you have kids that the days are long and the years are short, and certainly that applies to the last twelve months. A blur and a slog all at the same time.

Looking Back to March 2020

I’ve mentioned this before, but I’ve kept a U of A basketball ticket from March 5, 2020 on my desk for the last year to remind me of the pre-COVID times and how quickly the world changed. My wife and I attended that game with over 10,000 people at an indoor arena and thought nothing of it. At the time there were a handful of COVID cases in the U.S., but it still felt distant and intangible–I don’t even know if I had heard the term “social distancing.”

One week later and the NBA was indefinitely postponing its season. Perhaps it’s telling of my interests at home that it took the cancellation of a major sport to mark that moment in time for me; to be fair, nothing like that has ever happened before. Tom Hanks then announced he had the virus. More celebrities, athletes, and global leaders were coming down with cases of the virus to the point where it felt like we all already had it. In hindsight, I suppose that would have been a good thing, it would have indicated the virus wasn’t as deadly as we may have feared. Alas, that wasn’t the case. The next twelve months (and counting) would prove to be pretty chaotic, but it was those initial three weeks that held all the chaos from the perspective of the stock market.

Three Weeks of Stock Market Uncertainty

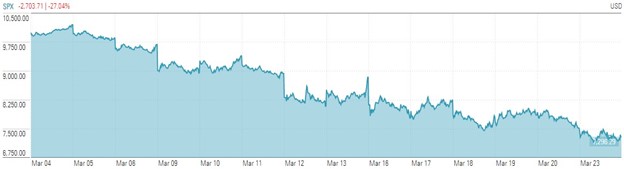

Between March 4, 2020 and March 23, 2020, the S&P 500 Index lost over 27% in value. To some degree that’s an understatement to how it felt because those 14 trading days included losses of 7.6%, 9.5% and 11.98%! There were also one-day gains of 6.24%, 9.3% and 9.4%! It was the most volatile three weeks since the Great Depression. Here is a chart of the S&P 500 over those 14 days.

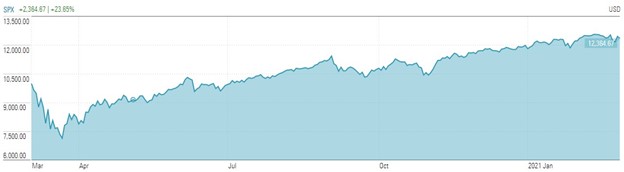

March 23rd turned out to be the bottom of the panic, which of course no one knew at the time. Below is a chart of the last twelve months, it’s not all that distinguishable from any other longer-term chart of the S&P 500: bumps along the way but overall an upward trajectory.

The last twelve months taught (and re-taught) a ton of investing lessons. There was also plenty to reflect on throughout the entire pandemic, but today I want to specifically revisit those three weeks. Volatile markets are often described as unprecedented, but that term is overused and rarely actually true—the market’s long history guarantees that we have almost always seen similar market movements at some point.

Why Reacting to Economic News Felt Different During COVID

What was unprecedented about last March was that we don’t usually have events that are a huge risk to our finances and health at the same time. What were you feeling? I was feeling some very heavy weight on my shoulders, that’s for sure. I had clients and employees that needed comfort and reassurance, and my family at home that needed the same. I am someone who doesn’t get rattled—the joke around the office is that if I’m stressed, then everyone else must be too. Even I had my moment of doubt: Was this time different?

When markets get volatile, our reptilian brain kicks in. Combine it with an event like a pandemic that is threatening other part of our lives, and our survival instinct kicks into hyperdrive. We’re anxious and nervous and we want that feeling to stop. The problem is that the most obvious action—selling your stock positions—doesn’t really solve the root issue. It may temporarily help, but you’ll soon realize the anxiety doesn’t go away. You’ve created the need for another future decision: When do you get back in?

Sometimes Not Reacting is Still a Reaction

It’s vital to remember that choosing not to react and trust your long-term plan is, in fact, an active decision. The flaw during periods of high volatility comes in thinking that you need to do something different. Regardless of the cause of market volatility, we know how to come out stronger on the other side—stick with a disciplined rebalance strategy and tax-loss harvest where appropriate.

It won’t surprise you that during the time of uncertainty I found comfort in the investment truths that I’ve spent my professional life researching. Like every advisor here at TCI, my job is to be objective and unemotional so I can help others make rational decisions when it’s very challenging for them to do so on their own. It didn’t matter what I was feeling—I had promised my clients (my company and family, too) we would get through this together.

The good news is that it’s hard to fathom a bigger test of our ability to stick to a plan than the last twelve months. For those of you who have been investing for the last several decades, the combined experience of the 2008-2009 financial panic and the 2020 COVID panic should serve to confirm that you can make it through whatever comes next.