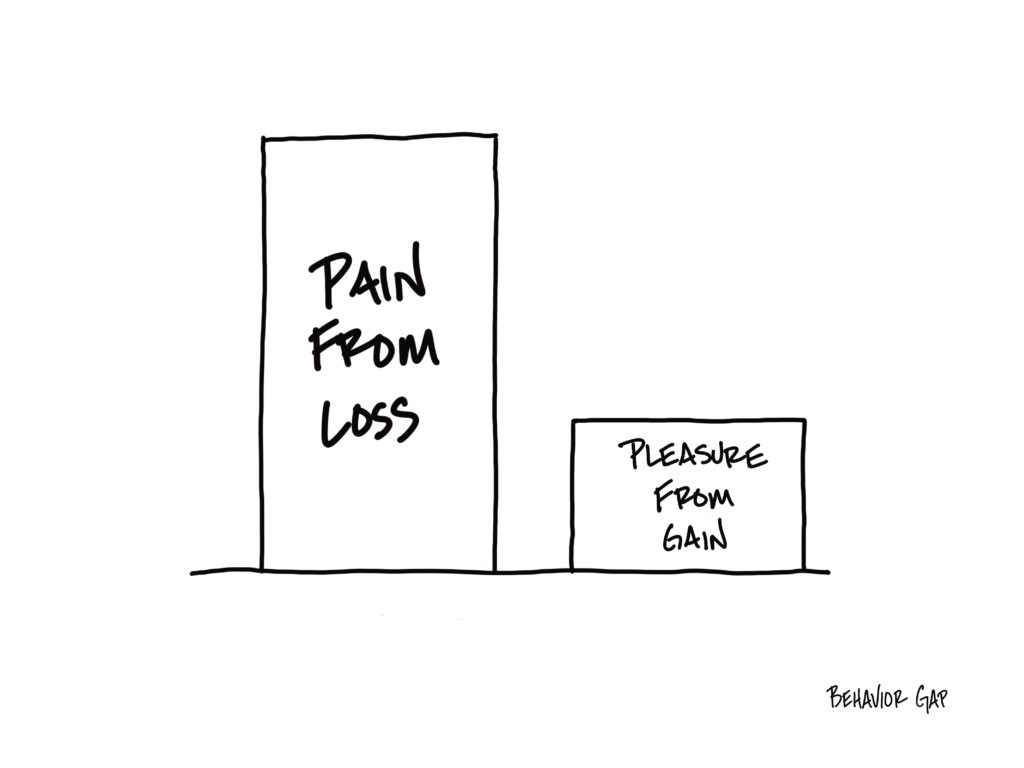

This week I couldn’t stop thinking about this illustration (above) from Carl Richards. It deals with loss aversion, but I wasn’t necessarily thinking about it in a financial context. This is a busy sports weekend: Super Bowl on Sunday, the Winter Olympics are taking place and it’s the Phoenix Open. All of these competitions are going to produce winners…and others who don’t win. Once the competition part subsides, by and large, it’s over for us as spectators, unless we’re invested in a team or individual. Yet, one of the things that always captivates me about athletes is the way they talk about losses. The wins are great, but the losses can haunt them for decades. Carl’s sketch illustrates these feelings exceptionally well.

The Power of a Loss

At TCI we’re cognizant of the power that emotions, especially losses, can play in investing. With our approach to investing we try to remove emotions whenever possible and make decisions based on the best available data. We know that market downturns are going to happen, so we build in some buffers to limit the feelings of loss during these times. This is the reason we structure our portfolios the way we do: emphasizing diversification, discouraging market timing and focusing on long-term results.

Our goal in being your trusted financial advisor is to help see your financial dreams come to fruition so you can lead a life that gives you purpose. When you reach this point, it isn’t about wins and losses anymore, it’s about finding fulfillment and seeking joy. Until then, channel the greatest coach of the last 20 years when it comes to market swings, Ted Lasso:

“You know what the happiest animal on Earth is? It’s a goldfish. You know why? It’s got a 10-second memory.”