HAPPY BIRTHDAY WARREN BUFFETT

Warren Buffet is the greatest investor of our lifetime, and he is far more than that. The man, who turned 90 on Sunday, August 30, is a leader, mentor, philanthropist, and he is respected all over the world and across cultures. Despite his advanced age, Uncle Warren is still, and always will be, in his prime.

Mr. Buffett has achieved enormous success in his life, amassing a fortune of around $80 billion in net worth and building a company, Berkshire Hathaway, that pretty much owns everything, with a market cap over $520 billion. But here’s the thing… It’s not the business success that makes Warren Buffett, well, Warren Buffett. It’s the fact that he is perhaps the one person who is able to make such unfathomable wealth and success seem attainable and accessible to the rest of us. He is not an A-list celebrity with the dashing good looks or the super-human sports star with the cannon for an arm and jet packs on his feet. He is the American Dream from Omaha, Nebraska whose success comes from embodying those hero archetypes that we all have the ability to have ourselves: integrity, loyalty, humility, and courage.

He is a leading proponent of the concept of enough. He plans to give away 99% of his fortune to philanthropic causes in his lifetime. In fact, despite all of his accomplishments, the most notable is his establishment of The Giving Pledge, in partnership with the Bill & Melinda Gates Foundation. More than 200 of the world’s wealthiest individuals and families have committed to dedicate the majority of their wealth to addressing the world’s most pressing issues because Warren Buffet asked them to do so. Amazing.

The people who you look up to look up to Warren Buffett. When the Most Interesting Man in the World needs advice, he turns to Warren Buffett. There is a high probability that at some point in your life, you worked for Warren Buffett.

So in honor of the man who has had such a tremendous impact on so many people and institutions, a man who is leading the way in making the world a better place, I want to share with you a few of the lessons that I have learned from him, using his own words.

Discipline and investing for the long-term: “Someone is sitting in the shade today because someone planted a tree a long time ago.”

Investing for the long-term is better than short-term profits and market timing. You know it and I know it, but that doesn’t mean that we don’t ever find ourselves thinking about the temptation of stock picking or frustrated by the market downturn. “American business — and consequently a basket of stocks — is virtually certain to be worth far more in the years ahead.”

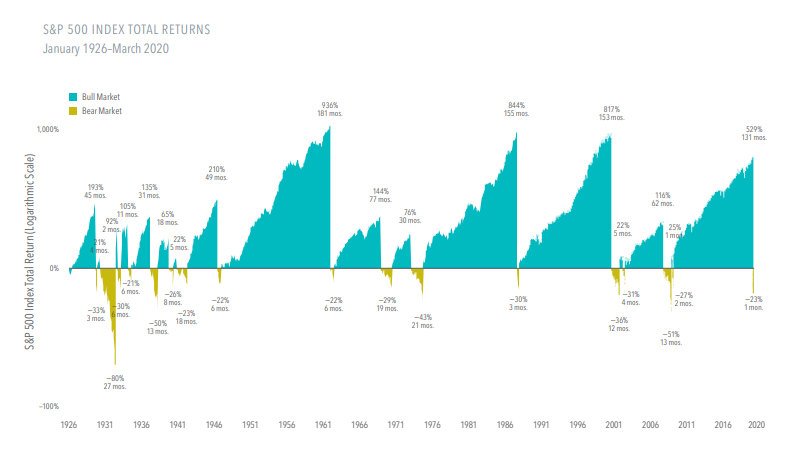

This chart from Dimensional Fund Advisors shows that bull markets far outpace bear markets, indicating that equities reward the disciplined, long-term investor.

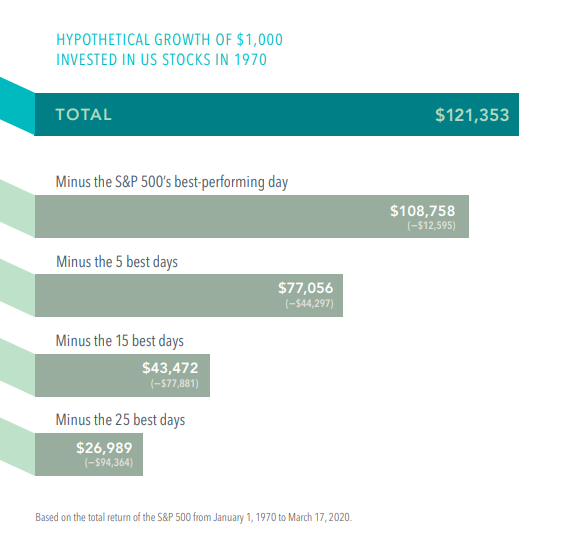

The U.S. stock market has returned 10% a year on average, dating back to 1926. “Do not take yearly results too seriously. Instead, focus on four- or five-year averages.” You’ve seen this one before, but the lesson cannot be stressed enough, market timing does not beat a disciplined approach.

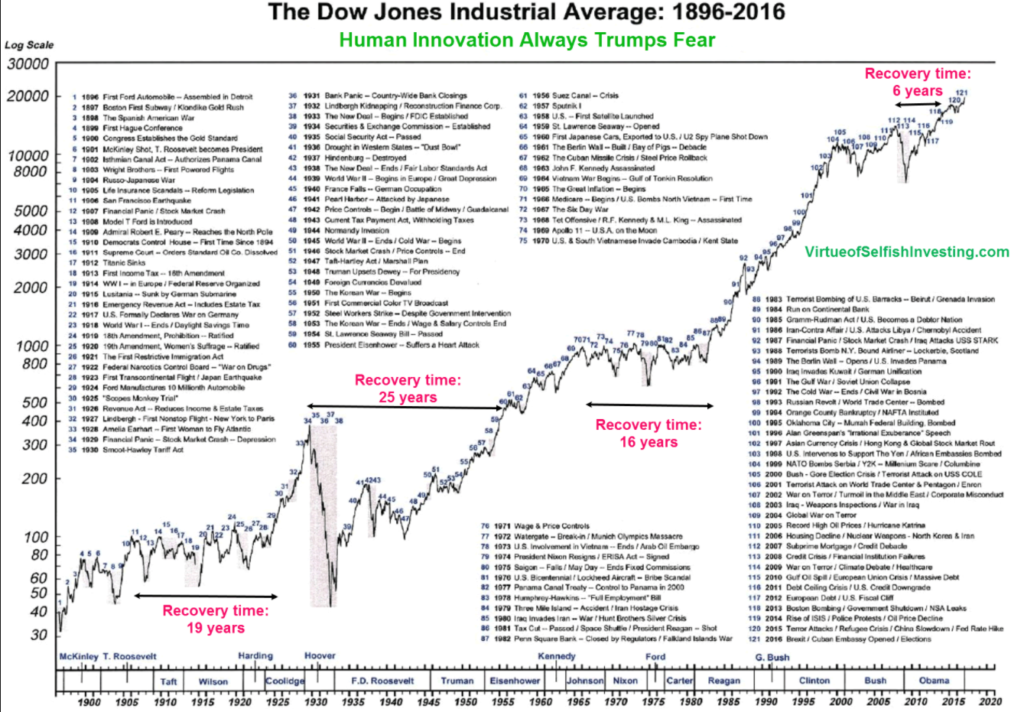

“In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

MarketWatch: The Dow’s tumultuous history, in one chart.

“The years ahead will occasionally deliver major market declines — even panics — that will affect virtually all stocks. No one can tell you when these traumas will occur.” But “predicting rain doesn’t count, building the arc does.”

Trust and integrity are everything: “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

Doing the right thing and putting others before self is not a difficult concept. But many industries have proven time and again that profits before people is their number one priority. Survey after survey shows that trust is low across industry and sectors, and with good reason. Warren Buffett has been a loud voice to the contrary his entire career. He built his empire by doing the right thing and doing right by others. He is known for quick negotiations and hand-shake deals, and that is why people want to work with him.

The finance industry has always been morally shallow. Deregulation and anti-regulation have left many industry sectors to operate on the honor system, and consumers have paid the price for it. It’s quite sad, actually, that firms are not required to put the best interest of the client ahead of their own, and that holding yourself out to be a fiduciary is a differentiator. I’ve never understood that, but perhaps that is why Warren Buffett’s lesson on trust and integrity have always hit home.

Doing the right thing and doing right by others feels good, and it is good for business. Companies with high trust factors grow exponentially more over the long-term than companies with poor reputations. Profits are higher, employees are more engaged, and clients are better served.

“Lose money for the firm, and I will be understanding. Lose a shred of reputation for the firm, and I will be ruthless.”

Be committed to a lifetime of learning: “I just sit in my office and read all day.”

Knowledge is the most valuable and potent resource, and Warren Buffet has a lot of knowledge. He is known to be a voracious reader, spending 80% of his time reading and consuming up to 1,000 pages per day. “Look, my job is essentially just corralling more and more and more facts and information, and occasionally seeing whether that leads to some action,” he once said in an interview.

He is also known to be quite generous with his wisdom — hence the lessons learned in this article. “Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.”

Some of his book recommendations include: The Outsiders, by William Thorndike, Jr., The Clash of the Cultures, by Jack C. Bogle, Business Adventures, by John Brooks, Essays in Persuasion, by John Maynard Keynes, and Dream Big, by Cristiane Correa. There are plenty of others, but these should get you through the week.

“One can best prepare themselves for the economic future by investing in your own education. If you study hard and learn at a young age, you will be in the best circumstances to secure your future.”

Health and wellness are more important than money: “The most important investment you can make is in yourself.”

Absolutely critical. Health and wellness are the first measures of success. And how do we get there? “The difference between successful people and really successful people is that really successful people say no to almost everything.” The point here is that balance is crucial. Work hard and be smart about it. By work I mean work hard on your career, work hard on your family, work hard on your faith, and work hard on your fitness.

Political elections don’t matter to the stock market: “I won’t say if my candidate doesn’t win, and probably half the time they haven’t, I’m going to take my ball and go home.”

Sam Swift recently wrote about How the Election Could Affect the Market. I’ll let you read the article and see for yourself, but the point is that election outcomes bear no impact on the disciplined, long-term investor.

Look after others and be generous: “If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”

When describing the Giving Pledge, Bill Gates says that it “is about building on a wonderful tradition of philanthropy that will ultimately help the world become a much better place.” The goals of the initiative are as follows:

- The social norm that the wealthiest people are expected to give the majority of their wealth to philanthropy and charitable causes will be strengthened.

- Philanthropists committed to large scale, high-impact giving will come together to exchange knowledge, experiences, and lessons learned from their philanthropy.

- Conversations, discussions, and action will be inspired, not just about how much to give but also for what purposes and to what ends.

Today, the Giving Pledge includes more than 200 of the world’s wealthiest individuals, couples, and families, ranging in age from their 30s to their 90s. Globally, they represent 23 countries: Australia, Brazil, Canada, China (mainland, Taiwan, and Hong Kong), Cyprus, Germany, India, Indonesia, Israel, Malaysia, Monaco, Norway, Russia, Saudi Arabia, Slovenia, South Africa, Switzerland, Tanzania, Turkey, Ukraine, UAE, the United Kingdom, and the United States.

HAPPY BIRTHDAY, WARREN BUFFETT. THANKS FOR ALL OF YOUR WISDOM, SUCCESS, AND LEADERSHIP. LOOKING FORWARD TO YOUR NEXT LESSON.