Diversification is one of the oldest and most successful principles in investing. It has been a cornerstone of TCI’s investment philosophy since we started guiding clients on their financial journey’s more than 30 years ago. Yet, it has recently found itself under scrutiny given the strong performance of the S&P 500 over the last several years. Investors often ask us, “Why should I own anything else than big U.S. stocks when they have vastly outperformed the rest of global market for the past decade?” It’s a reasonable question to ask, so let’s address it. First, the data.

A Historical Perspective on Diversification

To illustrate the importance of diversification, TCI’s Investment Committee conducted a study comparing two portfolios over the past 25 years, from 1999 to 20231. Both portfolios held 60% stocks and 40% bonds, but one portfolio’s stock allocation consisted solely of the S&P 500, while the other was diversified across countries, size, and fundamentals.

The findings illuminated why we rely so heavily on data when answering questions like this:

- 25-Year Total Return: The S&P 500-only portfolio achieved a total return of 5.97%, while the diversified portfolio slightly outperformed with a total return of 6.06%, with both portfolios showing very similar levels of volatility.

- Last 10 Years: The S&P 500-only portfolio returned 8.19%, significantly outperforming the diversified portfolio, which returned 5.58%.

- First 15 Years (1999-2014): The diversified portfolio returned 6.37%, considerably higher than the S&P 500-only portfolio’s 4.55%.

These figures highlight a critical point: while the S&P 500 has outperformed in recent years, the diversified portfolio remains the better option over the entire time horizon.

Annual Returns and Performance Patterns

Examining the annual returns over the past 25 years provides further insight into the benefits of diversification. The diversified stock portfolio outperformed the S&P 500-only portfolio in 15 of those years. Notably, the U.S. portfolio has outperformed in eight of the last 11 years, contributing to the current perception that diversification is less effective. Had we looked at the end of 2012, you’d have been looking at a diversified portfolio that had outperformed the concentrated portfolio in 12 of the last 14 years. None of us would have suggested getting rid of the S&P 500 as part of our allocation then and we shouldn’t be tempted to throw out everything else today.

The strong performance of the S&P 500 in recent years doesn’t invalidate the long-term benefits of diversification—I love it when it outperforms! After all, we have more exposure to the S&P 500 than any other asset class, but the key is that it’s not the only exposure we have.

The True Purpose of Diversification

Academically, the primary goal of diversification isn’t to chase higher returns but to manage risk and navigate periods of underperformance in concentrated asset classes. So, what does diversification mean for you? By including diversification in your portfolio, your Advisor is attempting to reduce the risk of you not meeting your goals. We don’t have to go back very far to see how concentration can sink an otherwise well-thought-out plan. From 2000-2010, the total return for the S&P 500 was effectively 0%! That “lost decade” had a profound impact on the ability to compound wealth over a lifetime for anyone concentrated in what they knew and what had just done well.

How Our Natural Biases Affect Us

In many parts of our lives, “recency bias” is a cognitive bias we all need to be aware of, but particularly in investing. Recency bias is the cognitive bias that has us give much more weight to recent events. An undisciplined investor succumbing to recency bias would constantly be chasing whatever had just done well and dumping whatever had not—in other words, often buying high and selling low, or the opposite of what we want to do over time.

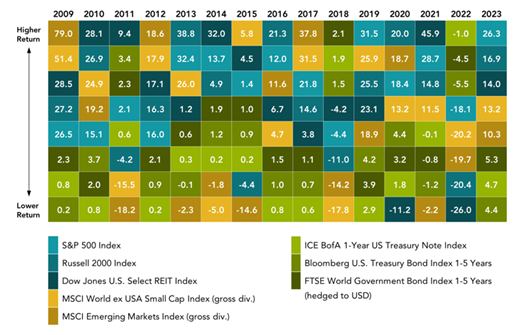

Recency bias, however, is not the only thing about ourselves we need to be aware of. In the case of the S&P 500 being the best performing index of the last several years, we also need to watch out for “familiarity bias.” That is, we tend to have an inclination to want to invest in things we know over things we don’t, all else being equal. Well, thanks to the media, the ups and downs of the S&P 500 (and Dow Jones Industrial Average) are plastered all over our screens every day. The index contains all the public companies you are likely to be aware of and very few that you wouldn’t know by name. But concentration in any one sector of the market assumes that you can predict the future, and there is no evidence for this being possible. Look at the chart below2 for the last 15 years—even the wonderful performance of the S&P 500 rarely resulted in it being the best performing asset class in any given year.

Staying Committed to Diversification

Diversification remains a cornerstone of sound investment strategy. It provides a buffer against market volatility, helps manage risk, and supports long-term wealth accumulation. While the S&P 500’s recent performance may tempt investors to question the value of diversification, it’s crucial to stay focused on the bigger picture.

By diversifying the stock portion of your portfolio, you’re not just aiming for higher returns; you’re building a resilient investment strategy that can withstand the ups and downs of the market. Remember, successful investing is about staying disciplined, avoiding the traps of recency and familiarity bias, and keeping your eyes on long-term goals.

In the end, the true power of diversification lies in its ability to help investors ride out market turbulence and emerge with more stable and sustainable wealth. So, while it’s natural to be influenced by recent trends, staying committed to a diversified approach will serve you well in the long run.

1 – Case studies presented are purely hypothetical examples only and do not represent actual clients or results. These studies are provided for educational purposes only. Similar, or even positive results, cannot be guaranteed. Each client has their own unique set of circumstances so products and strategies may not by suitable for all people. Please consult with a qualified professional before implementing any strategy discussed herein.

2 – Chart provided by Dimensional Fund Advisors.

TCI Wealth Advisors, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.