Debt vs. Savings – What to Prioritize?

One of the most common questions that comes up when I’m working with clients is how to prioritize debt paydown vs. contributing to (or not pulling from) their investments. The good news is that either choice increases net worth, so the question is better framed as, “what side of the ledger is it better for me to devote resources to?” Of course, the answer depends heavily on your unique situation, but I think it makes sense to walk through some guidelines for the process I typically use in formulating a plan.

The Pure Financial Answer

In its simplest form, we’re trying to answer a basic math question. To start with, one of the most important determinants is the interest rate associated with your debt. When you make extra principle payments on your debt, you can think of it as locking in a return on those dollars. As an example, if you have $1,000 in debt at 8% interest then you can pay off the debt immediately and save $80 over the course of the next year in interest payments. That’s basically the same as if you invested the $1,000 for the course of the year, made 8% and then paid off the resulting $1,080 balance at the end of the year. Of course, there’s no guarantee that you would make 8% by investing money for the year whereas you can guarantee that you won’t accrue $80 in interest if you pay off the $1,000 balance at the beginning of the year.

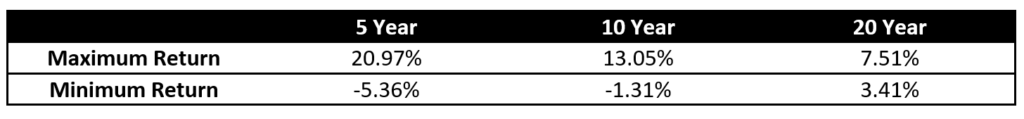

The typical “spreadsheet” answer is to compare your interest rate to what you think your investments would earn over the payoff time period. If you think you’ll earn more in your investments then you shouldn’t pay off the debt; if you think you’ll earn less then you should. This is too simplistic, though. The certainty of the debt interest rate has a value to it that needs to be factored in, because you can’t be sure what your investments will earn even over long periods of time (shown below through rolling return periods of the MSCI All Country World Index since 1994):

You can also see from this table that the longer the debt payoff time period and lower your interest rate, the more likely it makes sense to forego extra principle debt payments as long-term investment returns become more predictable. Short-term, high-interest credit card debt carries a high “certainty value” whereas a 30-year fixed mortgage looks different.

The Real Answer

More importantly—and here’s the part that’s unique to each individual—there will always be a “peace of mind” value that’s unique to you. You may place an extremely high value on eliminating the monthly payment for your mortgage or student loans. Even though the “spreadsheet” says you shouldn’t pay off that 5% debt, the “peace of mind” value you receive is well worth the opportunity cost of potentially higher investment returns with those dollars.

In my talks with clients, I’ve found that the following guidelines help in formulating a plan. Under current conditions, if your debt is at a rate 4% or less, I would strongly encourage you to not make excess payments and devote extra resources to other goals. If your debt is at a rate above 7%, I would start encouraging you to make excess payments. Within that range though, it really comes down to the value you place on the “certainty” and “peace of mind” factors and where you are on your financial journey.

In the end, the pure financial answer assumes that your goal is to maximize wealth. The actual goal, however, is that most of us want to maximize wealth within certain constraints. In other words, our time, energy, and “peace of mind” are all needs we consider as well. The question of paying down debt vs. saving into your investments is just another example of keeping the whole picture in mind.