Back to Basics | Part III

We left last week continuing to explore our investment strategy acknowledging the reality that the value premium has been negative across all markets for the ten-year period ending in 2019. Conversely, the profitability premium and the market premium have been strongly positive over that same period while the small cap premium has had mixed results (positive internationally but negative in the US). Nevertheless, when you have data that runs counter to your working theory spanning over a significant time frame, it’s worth asking whether things are different now.

Why do premiums exist?

I always return to the fundamental question of why premiums exist in the first place. The reality is that not all securities have the same expected return. Expected returns are driven by prices investors pay and cash flows they expect to receive. This is summed up by the (very) simplified equation below:

If I’m buying any individual stock, the price I am willing to pay (market value in the equation above) depends on the future dividends and capital appreciation I expect to receive (expected future cash flows) divided by the rate of return I want to achieve (discount rate). If I’m looking at two stocks with the same expected future cash flows, but one is trading at $12 and the other at $15, what is happening on a fundamental level? Investors are demanding a higher rate of return on the lower priced stock! Now, there can be all kinds of reasons for this, but the bottom line is that investors as a collective have determined that the lower priced stock is riskier. What do we know about risk and return? The riskier an asset is in the short-term, the higher return we can expect over the long-term. If I can group together many of these stocks with higher discount rates, then I should expect higher returns in the future.

This framework explains each of the four premiums from a risk/return perspective. For the market, small, and value premiums, you’re looking at assets that have more volatility to their expected future cash flows than their counterparts (t-bills, large stocks, and growth stocks) and demand a higher discount rate (and future return) because of it. The profitability premium is a bit more complicated, but essentially provides a way to separate certain stocks that are likely to have greater expected future cash flows than the market is pricing in (and thus you would see greater returns as those cash flows rise).

Having determined last week that the four premiums are robust across markets, and having determined this week that there is a fundamental risk/return reason they exist, we can next explore how premiums occasionally don’t show up over significant periods of time.

What if the returns this year are negative?

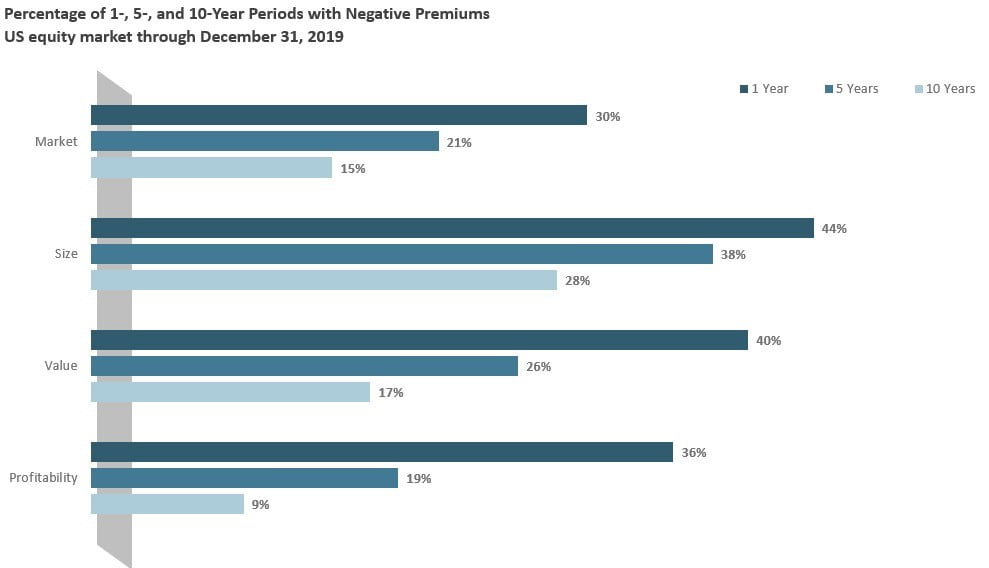

As we saw in last week’s post, even though the odds are strongly in our favor, it is not unrealistic for a premium to be negative over ten-year periods.

Unfortunately, we all don’t have an indefinite period of time to invest. We’re humans (at least I assume you all are, even if the Pentagon did just release those UFO videos). Ten years is a long time in our lives! It’s not unreasonable to think that you may not want to take on the risk, for example, of tilting towards small caps given the chance you may not live long enough to see the bet pay off.

How does diversification help?

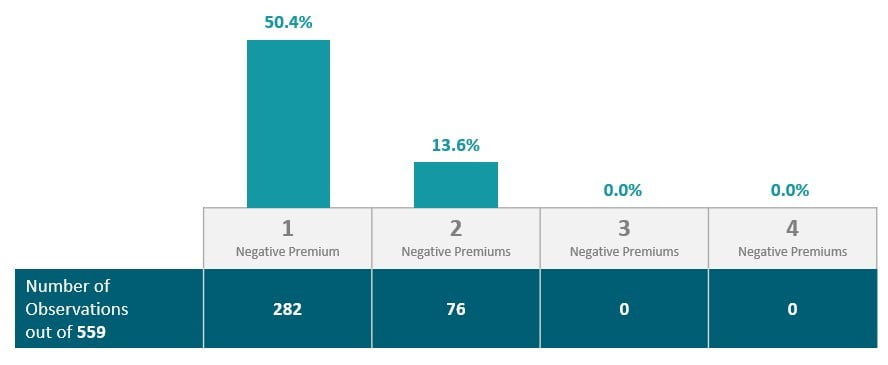

Here is where we get to bring another fundamental building block of investing back into the mix: diversification. Just as we diversify across markets and asset classes, it’s equally important that we diversify across the premiums because they do not move in lockstep. When looked at collectively, the numbers start to look even more favorable. The chart below shows how many times one, two, three, or four of the premiums have been negative over a ten-year time period going back to 1963 (that’s the farthest back good data goes for profitability).

By including all four premiums in a diversified portfolio, you are putting the odds in your favor. Half of the time you would expect all four to be positive. Five out of six times you would expect at least three to be positive, and you would almost always count on at least two being positive. Remember that choosing not to tilt towards small, value, and profitability essentially concentrates you in the market premium (this is what a pure index portfolio will do) and there’s a recent time period in the US where that would have been disastrous. The ten-year periods ending in 2008/2009 saw a negative market premium. Fortunately, small, value, and profitability were all strongly positive with premiums in the range of 6-8% during that time period. Starting with a market portfolio and tilting towards small, value, and profitability is your best defense against those occasional long periods where stock returns as a whole are underwhelming.

One last point I want to make is how quickly the premiums show up historically. I think most of us intrinsically understand this with the market premium. In fact, almost all of the historical market premium comes in less than 10% of the time. In other words, if you were invested 90% of the time, but just happened to miss the 10% of the time where markets rocket up, you’d be better off in T-bills. The same is true for the other premiums. Returns are concentrated and come very quickly when they do.

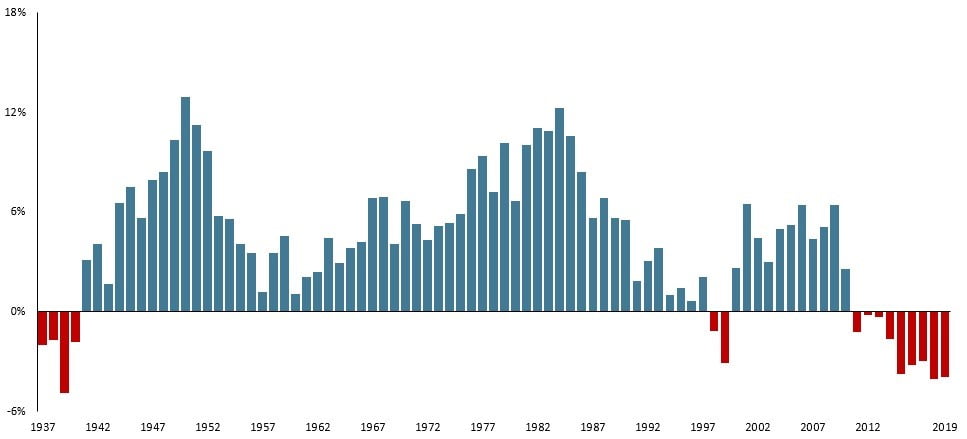

Circling back to value, let’s look at the below chart that shows the rolling ten-year returns of the value premium and explore a recent time period to demonstrate this.

As you can see, the value premium is largely positive, though we are currently in the midst of the longest negative streak we’ve ever observed. I will point you, however, to the last red period in 1998/1999 on the chart. At that point in time we were looking at a negative ten-year value premium on order of magnitude with what we observe today. Fast forward one more year, though, and the value premium roared back so strongly that it completely flipped the ten-year numbers back into positive territory. Much like the market bounces back out of crisis before the news starts to look very good (our latest example of this being the last several weeks!), so too have the other premiums historically.

We don’t know what the future holds, but we do know that diversifying across asset classes and premiums puts the odds in our favor. It gives us our best chance of gaining the returns we seek to meet our goals and achieve our purpose in life.