By: Cody Cassidy

The coronavirus has wreaked havoc on the global economy, and many of us have no reference point with which to gauge its severity and long-term impact.

Millennials have officially been “adulting” for a long time. If there is one thing that we have not experienced as enlightened adults it is the bear market, the recession, the global economic calamity last seen in 2008-09. At that point, we were so insulated from the “real world” that we were nigh on indestructible. Market crash? What is that? Vodka Red Bull will make it better… at least way more fun.

Now we are parents, established professionals, successful entrepreneurs, department heads, corporate giants. We don’t worry about having enough cash on hand to go out on Saturday night (we don’t even want to go out on Saturday night) but rather think about the quickest way to max out the Roth for the year. And while we have stressed out over establishing ourselves in a competitive job market, we have not experienced the uncertainty of a looming economic crisis that threatens our 401(k) and, in some industries, the job itself.

Here are a few important things to keep in mind:

What does a recession mean for my financial plan?

When markets take a downturn, the first thought a young saver should have is, “Good”. I certainly do not want to downplay the angst and anxiety that many are experiencing. This is not to be taken lightly by any means, and the health and well-being of our fellow humans is always first and foremost. So keep your focus on staying healthy and stop worrying altogether about your 401(k). Market drops are a good opportunity for everyone to buy because equities are essentially at a discount. So that bi-weekly contribution that you are making to your company retirement plan is going farther than it did previously. When the market rebounds and the economy steadies itself, your retirement account will be stronger than ever.

How do we insulate our financial plans from potential negative effects of a slowing economy?

This is one of those times when the emergency fund comes into play. You may be worried about dipping into that bucket, but a time like this one is exactly the reason why you built up an emergency fund in the first place. So if your hours are reduced at work or you have to stay home with the kids, feel good about the fact that you and your family are well-prepared. At this point you should be most concerned about figuring out how to come even remotely close to providing the high-quality educational environment that your kid’s teacher does. Just remember, you don’t stand a chance. And this is why we need to pay teachers more.

Should I be doing anything different with my investment portfolio?

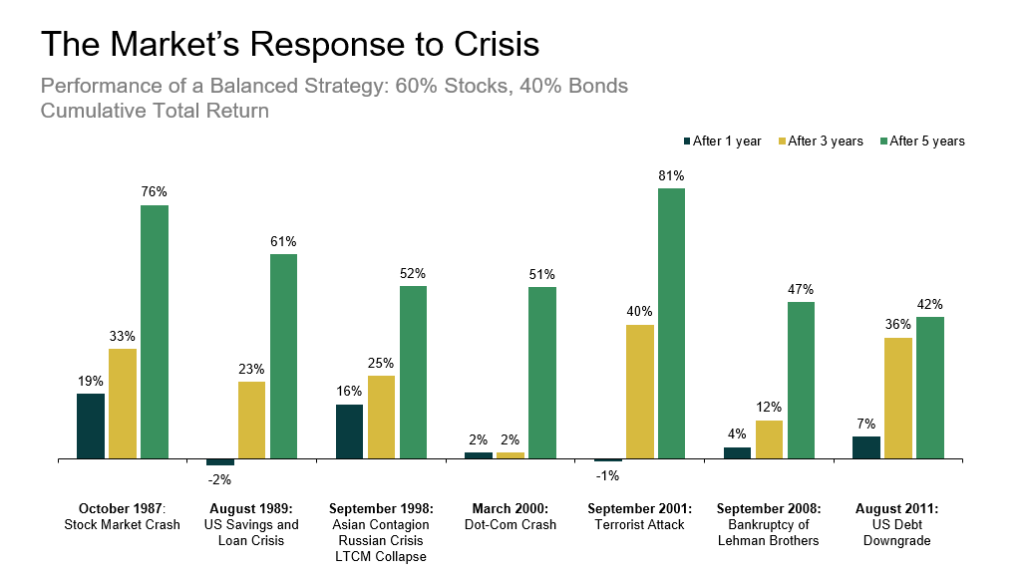

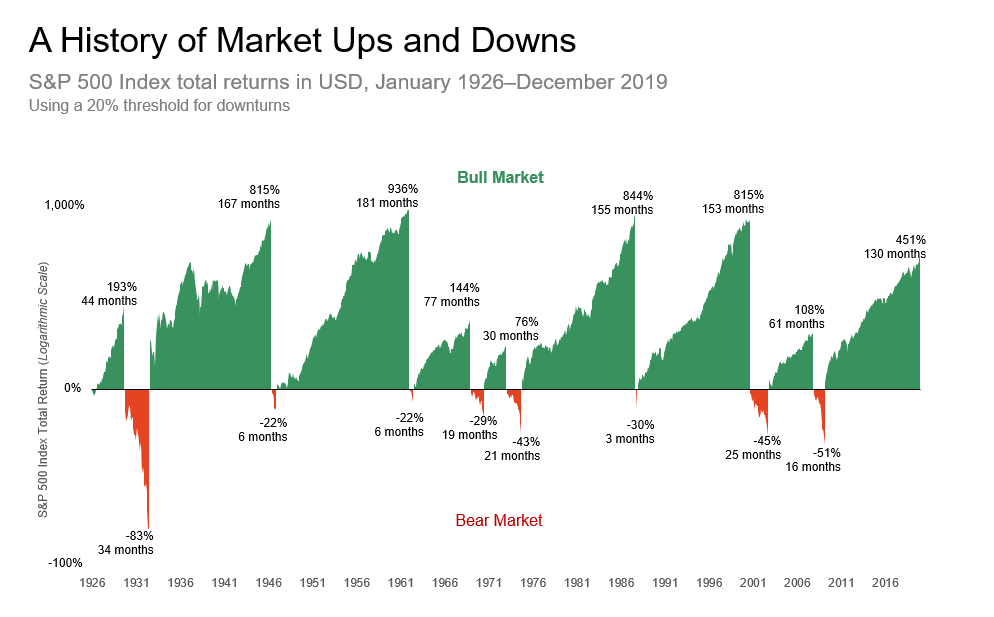

With a long time horizon (10+ years, and in most cases well more than 20) a majority of your retirement portfolio should be made up of well-diversified equities. Now is not the time to cash out and move to safer investments like bonds and CDs, or even cash. Remember, your retirement funds are long-term, so leave well enough alone and this market and economy will right itself and continue to grow. History is rife with economic turmoil, and the market has come out of each crisis stronger than ever.

One thing that can be beneficial at this point would be to accelerate your Roth IRA contributions. We don’t know when the market will begin to recover, but the S&P 500 is currently down 28% from the beginning of 2020. Buying now is as good a time as any, so if you have the ability to do so, max out the Roth now rather than waiting until later on in the year.

When will the markets recover?

Millennials are not used to the effects of global and national adversity. The last time we felt any sort of uncertainty as a collective group was September 11, 2001. That was a threat physical in nature and we felt not only our own fears but those of our parents and the rest of the household. The Great Recession of 2008-09 certainly impacted the oldest of our peer group and our brothers and sisters in Generation X, but we were for the most part insulated because we were in college or just starting out in our careers. Uncertainty, sure, but we did not have retirement savings and investment portfolios (or we had small account values). The following charts provided by Dimensional Fund Advisors illustrates the market’s response to major crises. In every instance the markets recovered and came back with gusto.

One last thing to take away from the current economic turmoil:

Remember how this one feels. Pay attention to your emotions. Our generation is going to experience more global crises and market downturns. Each one will be caused by a unique set of circumstances, and most will even feel different than all the others. This one will help you to keep it all in perspective, and prepare us to help the next generations get through it all.