One Tweet is Worth 1,000….Trades?

I had an interesting article passed along to me a couple of weeks ago and it’s only become more relevant since: Discount Brokerages to Donald Trump: Keep Tweeting

There are a couple lessons here that we can address:

- This is actually good insight into how markets process information, and

- This is further insight into why we should decline to participate in the daily noise.

Let’s address them one at a time.

It’s important to remember that prices reflect all publicly available information and investor expectations at any given time. The president’s tweets don’t have a direct impact on the fundamentals of any single company, but they definitely have an impact on investor expectations (tangent: it’s a little bit hard to believe that’s a sentence I can type with all seriousness in 2017). Thus, the brokerage houses see trading tick up significantly when a company is singled out. The direction of the change, of course, is hard to predict. Here’s the chart for Boeing during President Trump’s tweet—see if you can spot when the tweet happened:

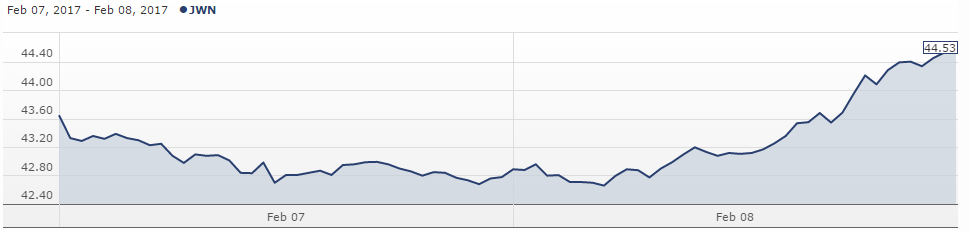

Interestingly enough, after dropping a couple points immediately the stock gained back all of its losses by the end of the day. Here’s the chart for Nordstrom after a February 8th tweet from the president:

Not as much of a spike in this case, but the shares finished up over 5% for the day. In either case, speculators are making instant trades based on guesses as to what a President’s tweets might mean for future sales or prospects for a company. It’s important to remember that it is not just a company’s fundamentals that set a price, but it’s the expectations of all investors that matter as well.

Regarding the second insight from the article, I hope it’s clear, but playing the speculation game is a losing proposition over time. To profit off of short-term trading in the market, you have to do all of the following things successfully:

- Correctly predict a future event (tough),

- Correctly predict when the future event will happen (tougher),

- Correctly predict how investors will react to that future event (okay, this is getting pretty challenging), and finally

- Overcome the costs associated with moving money around in an attempt to profit (seems impossible)

It’s the last one that the linked article really hammers on and it’s worthwhile to remind ourselves where the incentive for a lot of Wall Street lies—the more often money is moving around, the better it is for brokerage firms who collect commissions each time a stock or fund is traded.

Quick thought experiment: if you were to get paid more when trading volume increases, what kind of “advice” might you put out to the world? Perhaps the “advice” that investors should be reacting to each little piece of news….perhaps the “advice” that if investors are doing nothing then they’re missing out…or perhaps the constant “advice” that is pumped out about some new, hot investment.

The stock market is full of uncertainty on a day-to-day basis (that’s why we get paid in long-term expected returns) and 2017 has added a small bit more in the form of Presidential tweets. If that doesn’t tell you that predicting the future is extremely hard, I’m not sure anything will.