Happy New Year! Hopefully you all had a wonderful 2021 holiday season and you have exciting things to look forward to in 2022. If you’re the type that has New Year’s resolutions, I hope you’re successful in your endeavors. Despite my skepticism around starting something on a relatively arbitrary day, I keep coming back to the same resolution year after year. Nevertheless, there is something about the marking of time at the end of a year that lends itself to both looking back and looking forward. In that spirit, let’s revisit what 2021 brought to us as investors and what 2022 may hold going forward.

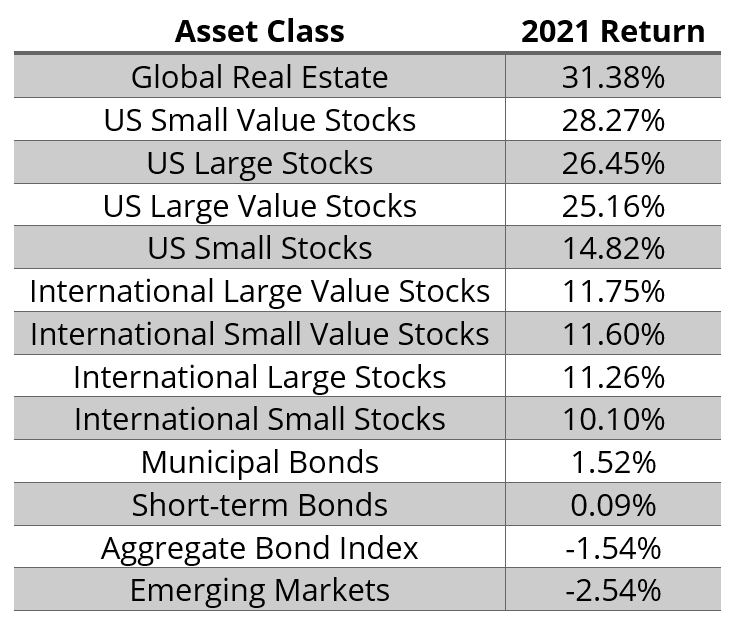

Asset Returns in 2021

For a second year, nearly all investment asset classes had positive returns, and many were in the double digits.

Global real estate led the charge as it recovered from pandemic effects felt in 2020. U.S. stocks in general had tremendous returns, with a strong recovery from small value stocks in particular pacing the way. International developed markets stocks continued to have double-digit returns, but again lagged U.S. stocks significantly. This was likely due to foreign economies lagging the U.S. in recovery in addition to a very strong dollar. When investing in foreign stock, most funds don’t hedge against currency movements intentionally—this creates lagging returns when the dollar is strong and strong returns when the dollar lags. Most importantly, it provides more important diversification. Emerging Markets (companies located in still developing nations) gave up all their gains at the end of the year to be the only stock asset class to end up in the negative. This was largely driven by the issues China was (and still is) having towards the second half of the year.

With already low interest rates and the threat of inflation becoming more persistent as the year went on, bonds had a challenging year. Municipals and short-term bonds remained positive, but longer-term bonds struggled. Of course, the primary purpose of bonds in a portfolio is to control overall volatility. During down years for the stock market, that will mean a cushion against losses in value. During up years for the stock market, that will mean lagging returns, and 2021 proved to be no exception.

Putting 2021’s Returns in Context

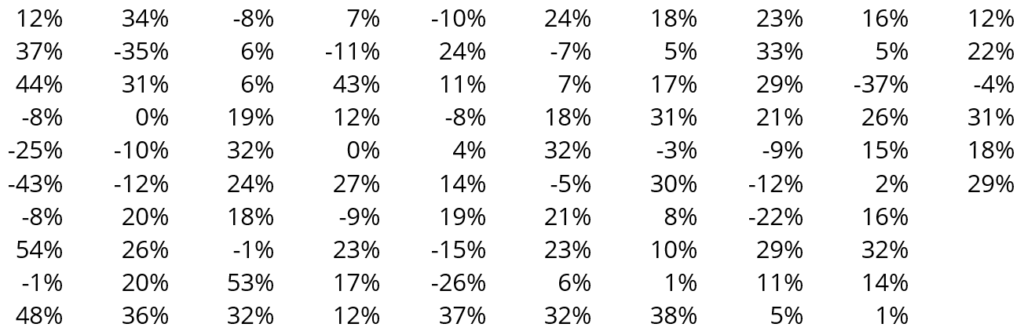

It’s worth remembering during both up years and down years that average isn’t normal. That is, the average returns that we expect from stock markets over long periods of time are unlikely to materialize over shorter time periods for better or worse. Below are the last 95 annual returns for the S&P 500 Index. The long-term average is just over 10%. See how many years you can find that resulted in a return close to the long-term average (let’s say within two percentage points):

Six! Three 12s, one 11, one 10, and one 8. Six times out of ninety-five do we see an annual return anywhere near the long-term average. It’s not normal! The ride will be bumpy, but fortunately owning a piece of global economic progress has more good bumps than bad.

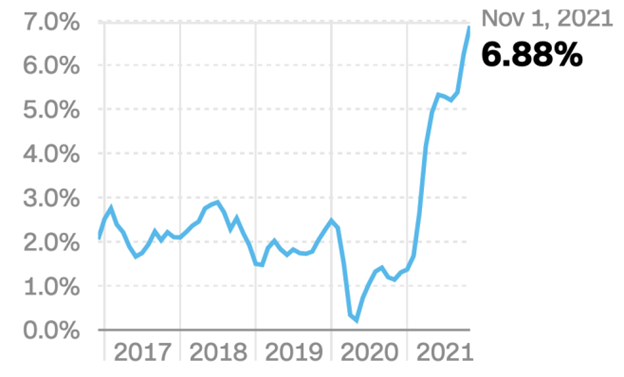

Last year’s positive bump, of course, happened in the face of some alarming headlines—the surge of the Delta and Omicron variants; continued domestic political polarization; global instability from Afghanistan to Crimea to China; another year of record-breaking wildfires; recent inflation numbers higher than the past few decades, pictured below; supply bottlenecks and worker shortages; etc.

Of course, there was also a ton of underlying good news—widespread vaccinations that are proving to be very effective in limiting severe illness and death against COVID; tremendous job and GDP growth, pictured below; rising wages; record corporate earnings; etc.

Looking Ahead to 2022

It’s not unreasonable to see competing narratives about the year to come, but when aren’t we looking ahead to mixed signals? It’s what makes market predictions so incredibly challenging. As consistent readers will know, one of my favorite phases these days is “tell me your conclusion and I’ll find you the supporting data!” At some point the markets will pull back, but that prediction has been loudly made for the last several years and you would be hard pressed to find another time in history that has matched this tremendous growth. Markets will surprise us—that’s the risk we take on as investors—but fortunately the good surprises outweigh the bad.

Despite somewhat downplaying New Year’s resolutions at the beginning, I implore each of you to be resolute on focusing on what you can control and recognize that future short-term market movement is not one of those things. If you already do that, as I know many of you do, pat yourself on the back and set your sights on another goal.

For example, my resolution, the one I make annually, is all about accountability, something that is important to me. I resolve to be a better person to my family, my community, the world and myself….and I further resolve to dial back that dozen cookie per day habit I picked up over the holiday season. I feel like I’ve been pretty successful on the first part, but those cookies sneak up on me every December.

Here’s to 2022!