Lately I’ve noticed a certain question popping back up: Is now the right time to be buying into the market? I can’t blame the questioners. We’re currently experiencing one of the longer bull runs in history and there are headlines every day wondering whether prices can really keep going up which culminated in my favorite just a few weeks ago (I’m paraphrasing because I can’t find the exact article now, of course): “Global Stocks Hit Record Highs Worrying Investors”

This mentality has flipped in recent years. It used to be that greed and FOMO (Fear Of Missing Out) were the dominant emotions and people wanted to rush into high markets. To be clear, it’s not like this has gone away as the new generation of day traders have been a consistent piece of financial news for a while now. For the most part, though, people seem to be waiting for the other shoe to drop likely because many still hold last year’s severe March or the relatively recent trauma of 2008-2009 close in their memory. Perhaps they are just concerned that market returns seem to be divorced from the headlines. This is an improvement, but it is still market timing in disguise. It’s worth repeating this mantra: We cannot control what is going to happen and we cannot successfully predict what is going to happen over the short-term.

Why are We Investing Anyway?

The challenge we should all pose to ourselves when making investment decisions is to ignore the noise and focus on the purpose. Why are we investing in the first place? Are these long-term dollars that won’t be touched until retirement? Is this some extra cash for a new car in the next two years? Is this money that is likely going to heirs?

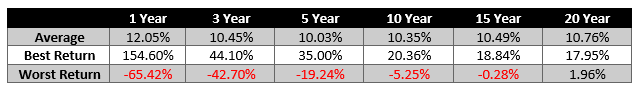

The chart below shows the best and worst returns over different time periods for U.S. stocks using data back to 1926.

These numbers include the Great Depression—all of the “worst return” periods begin sometime right before the crash.

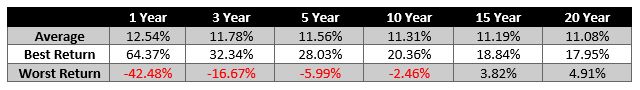

If we start the data in 1940 and remove the Great Depression, here’s what we are looking at:

Are You Investing for the Short-Term or Long-Term?

Regardless of the data set, the point remains the same. Notwithstanding what the market has done recently, it’s never going to be a good idea to save short-term money in the stock market. The risk is far too great that you will have less money when you check your account in twelve months—in fact, you should expect to have less about 40% of the time.

On the other hand, if this is long-term money of 15+ years it is always the right time to invest. Even the most extreme outcome of investing just prior to the Great Depression still resulted in the growth of wealth given enough time. Add in a disciplined rebalancing strategy and international diversification—neither is represented in these numbers—and the odds are overwhelmingly in your favor when you are looking far down the road.

Determining the right time to buy all comes back to your purpose–what are you trying to accomplish with this money and how much time do you have to do it? Basing investment decisions on anything else is a fool’s errand and is likely to harm what really matters. That’s why, week after week, I stress the importance of developing and sticking with a long-term financial plan. It’s worth repeating the mantra I mentioned earlier: We cannot control what is going to happen and we cannot successfully predict what is going to happen over the short-term. These are topics we love discussing and navigating with clients so be sure to reach out to your advisor with questions.