TCI helps clients navigate through all kinds of changes, but retirement is most often the major life transition that causes people to seek us out in the first place. As any client knows, there are countless numbers and scenarios to run through to make sure one is on track to achieve their goal, but I want to focus here on the non-quantifiable aspects of reaching retirement. TCI advisors have watched thousands of our clients make the transition and its often the psychological changes that prove to be the toughest challenge.

Filling Your Time as a Retiree

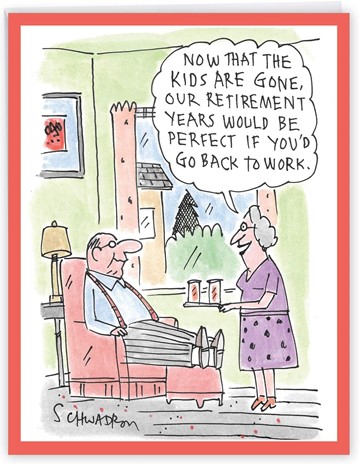

We live in a culture that values work a tremendous amount. There’s a reason the first question from someone you’ve just met at a cocktail party is so often, “What do you do?” In addition, most clients that we work with are high level professionals, business owners, or executives and have many issues they are responsible for and many people who rely on them. It’s a big change when that responsibility goes away.

I think of my grandfather when he retired. He spent his whole life as a priest. Financially he was covered by a modest pension from the church, but psychologically he went from his parishioners seeking advice and counsel on a daily basis to just being another face in the crowd. Now plenty of people still sought his advice, but his perception of retirement was almost as if he was forgotten. His whole life existed to serve others and suddenly nobody was seeking that service any longer. Retirement was not about financial anxiety for him, but it was a challenging psychological change, nevertheless.

TCI’s definition of “retirement success” is much more about the pursuit of happiness. Being financially secure is no doubt a part of that, but remember your advisor isn’t letting you retire unless she was already confident you would be financially successful! There are two things that I have seen some of our most successful retirees do.

The first is relatively simple: say “no” for at least the first six months. Unless you’ve done a lot of pre-planning, it’s worth taking a step back and getting a feel for what you want your post-retirement life to look like. Some have walked into too many volunteer or social commitments and ended up being more scheduled than when they were working! That may even be what you want, but I suggest taking a bit of time to figure out what schedule is going to work for you.

Second, most of our successful retirees dismiss the word “retirement” all together. Their goal is much more about financial freedom—the idea that you no longer need a paycheck and could live off your assets. That is not the same as not working. There are countless volunteer opportunities, social outings, and even paying jobs that can fulfill those needs my grandfather was missing, for example.

There is an additional benefit to achieving financial freedom but continuing to work. I’ve seen many business owners, once they are confident they have achieved financial independence, improve their business decision making. When you are free from the pull of trying to maximize short-term dollars, you can pursue more rewarding business strategy in the long-term.

So again, retirement doesn’t need to be synonymous with not working. It just means you have the freedom to do what you enjoy most.

Shifting from Accumulation to Decumulation

There is one major psychological change that is directly related to your finances. As you enter retirement, you are leaving a world where you have spent your entire life watching your investment accounts increase in value (with short-term bumps along the way, of course). Retirement often reverses that and starts the process of spending that account down. Some have planned for a specific legacy or were such good savers that they are in a position where their assets will fund their lifestyle and likely continue to increase, but most saved for all those years in order to spend it. Don’t discount the impact this can have on your emotions.

Perhaps it has to do with seeing a declining portfolio as a sort of ticking clock on the years we have left or perhaps it is just an anchoring challenge to shift focus from building something up to actually using it. Whatever the case, it’s a major shift in perception for many. Even when you know the money is there to be spent, it can still be tough to actually do so. What can help?

Mainly, making sure you have trust in a partner that can help give you the confidence that spending down your assets is the point! TCI advisors spend a lot of time going over scenarios so clients can know they are okay to enjoy the fruits of all their labor. For most, it is a balance of maintaining long-term security while still enjoying your life in the moment. Having confidence in the former with the help of a trusted advisor can allow you to get the most out of your resources.