If you’ve ignored the market for the past couple of months, then pat yourself on the back! Good for ignoring the noise! However, I’m guessing the majority of us have encountered the panic-inducing headlines no matter how hard we’ve tried to avoid them. Between “BREAKING NEWS ALERTS” that aren’t “BREAKING NEWS ALERTS” and the constant presence of market tickers on most screens we watch, it’s easy to mistake daily price changes as important information. With that in mind, let’s put the (admittedly bad) last couple of months in context and talk about what actions we should be taking.

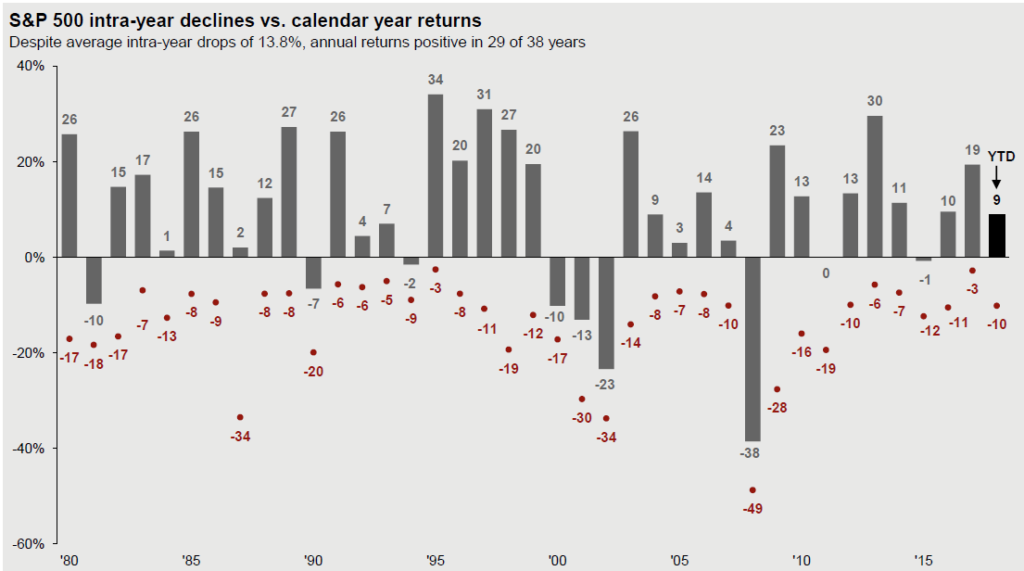

One of my favorite charts is the following that JP Morgan puts together that looks at yearly returns for the S&P 500 vs. the largest intra-year decline (the bars are the calendar year returns and the red dots are the largest drop that year):

The last column measures through September of this year. As I write this the S&P 500 is now down about 8% for the year with an intra-year drop of nearly 17%. That’s still well within the range of normal—unpleasant, but normal. And the key thing to remember is that despite an average intra-year drop of 13.8%, the S&P 500 returned 11.64% annualized over the entire time period. We get long-term returns because the ride will be rocky pretty often.

Another thing to keep in mind is that even if we turn out to be at the beginning of a bear market, we’ve likely experienced a significant amount of the pain already. The average bear market lasts for about a year and sees a drop in value of the stock market of about 35%. If we’re headed for an average bear market this time we’re nearly halfway there already.

Of course, no one knows if this is a temporary correction or the start of a bear market and don’t let them convince you otherwise. I only need to look back to August of 2015 to find multiple articles warning about the “overdue” bear market and how to prepare after a wild month of fluctuating prices. What’s the market done since those articles? The S&P 500 increased in value by 50%. It’s wise to remember Paul Samuelson, a Nobel prize winner in economics, who famously said that “the stock market has forecast nine of the last five recessions.” I repeat: no one knows.

Furthermore, recoveries happen fairly quickly. Of the last six bear markets, investors who stayed the course were back in positive territory (and often significantly so) five years after the previous high point. Even if someone put 100% of their money in stocks of October of 2007—the start of the worst bear market since the Great Depression—they were back to even in October of 2012 (and in really great shape in October of 2017!)

Of course, despite not knowing what the immediate future holds there are things we are doing to take advantage of the downturn—a silver lining, if you will.

First, we are looking for opportunities to realize losses in taxable portfolios. This is a technique that can reduce your tax bill today and improve the tax-efficiency of a long-term portfolio by offsetting gains we expect to have over the long-term.

Second, we are looking for opportunities to rebalance portfolios. When equity markets decline significantly enough, your portfolio is likely to become under-weighted to stocks and over-weighted to bonds. Rebalancing now provides us an opportunity to buy more stocks after they’ve become cheaper. The opposite is true during significant market increases where we would have the opportunity to sell stocks after they’ve become more expensive. Overtime, we end up buying low and selling high more often than not.

Finally, remember that your allocation is based on taking on an appropriate amount of risk given your goals. Factored into that is the reality that bad markets will happen fairly often. Nothing we have seen during the past couple of months should require a change in strategy. Our TCI team, of course, is always ready to talk and re-examine your situation should you have concerns.