Establishing Healthy Money Habits for Kids

It is an unfortunate truth that most schools don’t include any type of personal finance and investment management in their curricula. In fact, the first time that a large portion of young people in the U.S. are exposed to making decisions around investments comes when they are enrolling in their 401(k) plans at their first job out of college. Knowing this, it creates a great opportunity for you, as parents, to provide these foundational lessons around money, saving, and investing just as you would teach your child “right from wrong” or how to do their own laundry. Personally, I can say that having frequent discussions around money values, saving, and investing with my parents when I was younger contributed to my passion and confidence in this field today. You don’t need to be a financial analyst to have an effective impact on your child’s understanding of the values of saving and investing. Starting those money values lessons can begin earlier than you might think.

Money Habits Establish by Age Seven

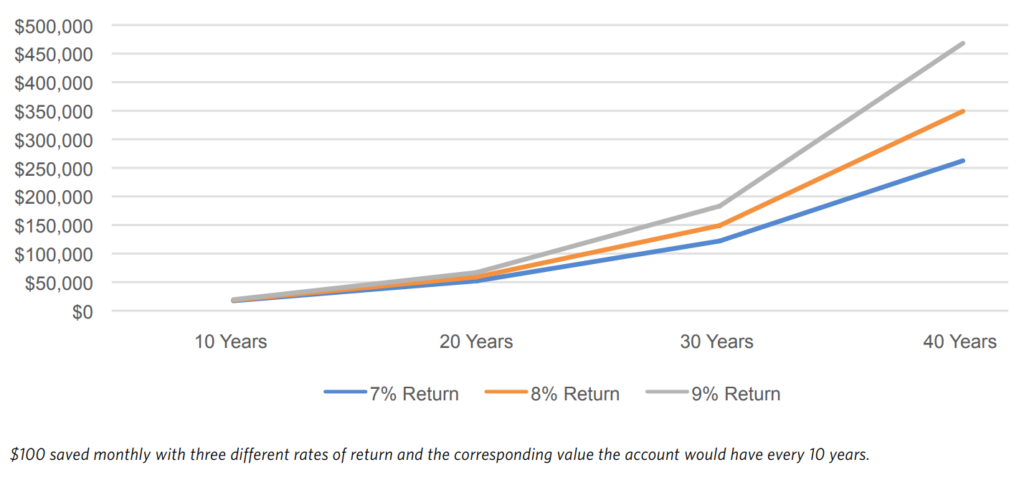

According to a PBS article, many money habits are already established by age seven. This may come as a bit of a shock! Yet, it is never too late to start the conversation with your children about basic money values (even if they are well past seven). Now, it makes logical sense that before you talk to your kids about stocks, bonds and investing you’ll need to establish the groundwork understanding of the value of money, saving and fiscal responsibility. These lessons can be imparted using everyday errands (talking through purchasing decisions while at the grocery store) or by implementing an allowance system. An allowance is a great way for kids to get early exposure to money management and budgeting–how much of my allowance will be spent versus how much will be set aside for savings. Be sure to include the concept of the time value of money and the values of starting to save early. Below is a chart that illustrates the power of compounding interest over time. Hopefully this can have a compelling impact on your child’s saving habits!

What comes next after your child has basic money values under their belt? It makes sense at this point to introduce the next “bucket” to consider in addition to spending and saving–investing. So where to start?

How to Start Teaching Kids About Money

- Make sure your child understands the differences between saving and investing, the latter is not meant for short-term money. There is greater risk associated with investing compared to a savings account. It also provides the opportunity for greater growth over time.

- Discuss what owning a stock means, purchasing a fractional ownership share of a company. We invest in stocks with the goal of seeing our investment grow in value over time with the company’s growth, however, not every stock will do that. Therefore, we spread our risk across multiple companies (diversification).

- A great way to illustrate the risk associated with owning one stock is to have your child select an individual stock for a company they would be familiar with and then watch the performance over time. Follow this company in the financial news to see how different events impact stock price. Like many kids, I grew up watching Disney movies, so you can probably guess which company I followed during my first lessons about stock ownership.

Once your child starts to earn a paycheck, the investing conversation can even be expanded to longer-term retirement saving strategies such as Roth IRA and 401(k). In the end, having these conversations with your kids will give them the tools and the confidence to start planning and saving for their futures. The thing to remember is that having these conversations with your children earlier rather than later will ensure you are having a direct impact on the formation of their understanding of the value of money. Not to mention, you will have a better chance of beating out social media.

Would you like additional help and resources? Your TCI Advisor is here to help! We are always available to be a part of these conversations with your children to help ensure they are prepared for what lies ahead.