It’s No Fun Out There – Fall 2022 Market Update

It has been a rough year for the markets, to say the least. After initially touching down about 23% for the year in June, the S&P 500 saw a quick recovery that erased more than half of those losses in just two months. However, the last 4-5 weeks have given up that brief recovery and many stock indices are revisiting their lows of earlier this year.

What makes things more painful is that the bond markets have not provided their typical stability. The rising interest rate environment has sent bond markets tumbling with the Aggregate US Bond Market dropping nearly 15% for the year—that makes it the worst bond market of the last 40 years. The combination of bonds and stocks seeing this much downside at the same time has limited the positive effects of diversification and make this a challenging year for investors.

Let me briefly point out a few silver linings:

- Bond prices are down because bond yields are rising. When we look to the future, being able to invest in bonds that yield 5-6% instead of 1-2% will help many of us when we need more income from our less risky assets.

- When you just look at the numbers, this is a relatively normal bear market thus far and we know those will happen every 3-5 years on average. In other words, this isn’t completely out of the ordinary.

- By overweighting certain sectors of the market, TCI portfolios have experienced a little less of the downside by a few percentage points. Things are still down significantly, but less so than the markets as a whole. Those percentage points may not feel like much in the near-term, but they compound into significant wealth over time.

- Bear markets typically last less than a year on average. Many of the markets best days occur in the first two months of the recovery, whenever that may come.

Those things are all true and would indicate better days are ahead in the future. Just because something is likely, of course, does not make it imminent and no one knows when things will turn around. More importantly, I know that those truths rarely make us feel any better in the moment.

Times like these are frustrating at best and legitimately frightening at worst. The value of your life’s savings is fluctuating and the reasons why are completely out of your control. It’s okay to feel that fear/anger/sadness…we all do to one degree or another. The danger is when we act on that emotion. I urge you to fight that feeling to do something radically different.

The most successful investors are those that refocus on the purpose of their dollars in moments like this and commit to the principles we know to be true.

- This is normal—markets will recover and we take an active approach to rebalancing and tax-loss harvesting with the goal of capturing that recovery most effectively.

- The past is obvious, but the future isn’t. Short-term market predictions are highly unreliable, so there is no point in acting on them.

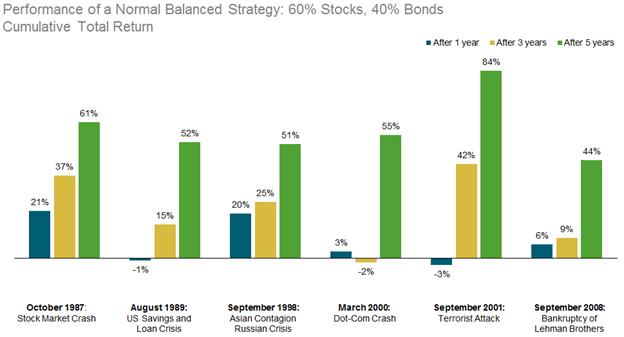

- Markets are resilient. The chart below shows returns after 1 year, 3 years, and 5 years for significant market events.

- Positive returns happen quickly and randomly. We must stay invested if we hope to reach our goals.

- You have a plan that accounted for market times like this. As Nick Murray, a respected financial industry expert and author, puts it, “All financial success comes from acting on a plan. A lot of financial failure comes from reacting to the market.”

We know it’s painful right now and we are here for you. We are staying disciplined to what we know works for you and your plan long-term. Markets will recover and we’ll be there to capture that recovery. Stay disciplined, stay diligent, and reach out to your advisor whenever you need.