Is AI Changing How We Should Think About Diversification?

AI has been impossible to ignore lately. From headlines about breakthroughs in generative models to the stock market dominance of a handful of mega-cap tech companies, it can feel like artificial intelligence is the only story that matters. Naturally, this has sparked questions from investors: If so much of the market’s recent gains are coming from AI leaders, should we be rethinking diversification to make sure we’re not left behind in the AI revolution? In tribute to Lee Corso’s final appearance on College Gameday, we’d say: Not so fast, my friend! The story of AI is much bigger and more nuanced than a handful of companies.

Lessons From Past Revolutions

As investors, what matters most are the opportunities ahead, and the biggest future beneficiaries of AI may not be the companies building it, but those beyond tech that put it to work. Vanguard’s Joe Davis1 has highlighted this point, noting that past technological revolutions played out in much the same way. When electricity transformed the economy a century ago, the gains didn’t come from the utilities generating power, but from companies like Ford and General Motors that reimagined their businesses around it.

The same was true during the internet revolution. While hardware and infrastructure providers made headlines in the late 1990s, much of the lasting value was created by firms in retail, media, and logistics that reinvented themselves around the new technology. In fact, from 2000 to 2010, when many investors wrote off the internet boom as a bust, some of the market’s strongest performers were non-tech companies that had successfully leveraged the internet to transform their industries.

AI in Action Beyond Tech

We’re already seeing echoes of that dynamic today, with companies outside of technology applying AI in powerful ways:

- John Deere is using AI-driven “See & Spray” technology to cut herbicide use by up to 90%2.

- Siemens has deployed AI-powered vision systems to improve quality control on factory floors3.

- UPS4 and FedEx5 are deploying AI-powered logistics systems to streamline delivery routes and enhance efficiency.

These examples show that the value of AI is not just limited to Silicon Valley. It’s reshaping industries across the economy.

The Risk of Concentration

While these examples show the promise of AI across the economy, today’s stock market tells a different story. Investor enthusiasm has flowed disproportionately into a handful of mega-cap AI names, driving their valuations to historically high price-to-earnings multiples and leaving the S&P 500 more concentrated in its top holdings than at almost any point in history.

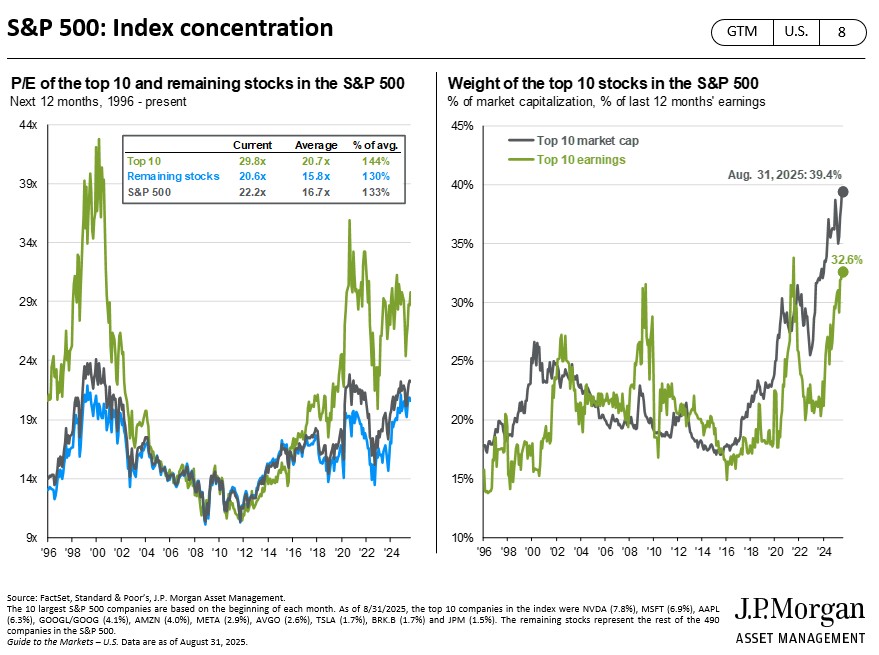

If we look at today’s market through the lens of valuations and concentration, the picture is striking. As J.P. Morgan’s Guide to The Markets shows6 the price-to-earnings ratios of the top 10 companies in the S&P 500 versus the rest of the index. As of August 2025, those top names trade at nearly 30 times forward earnings, well above both their own long-term average and the broader market.

The chart on the right shows how much weight those companies carry in the index: together, they now represent almost 40% of the market cap of the S&P 500, a historically high level of concentration.

Much of this imbalance is tied to the companies most closely associated with the AI revolution. Investor enthusiasm has pushed their valuations to levels that imply not just strong growth, but perfection. While AI will almost certainly transform the economy in meaningful ways, the question for investors is whether the expectations reflected in these prices are overblown relative to the actual economic value created.

History’s Warning on Market Leaders

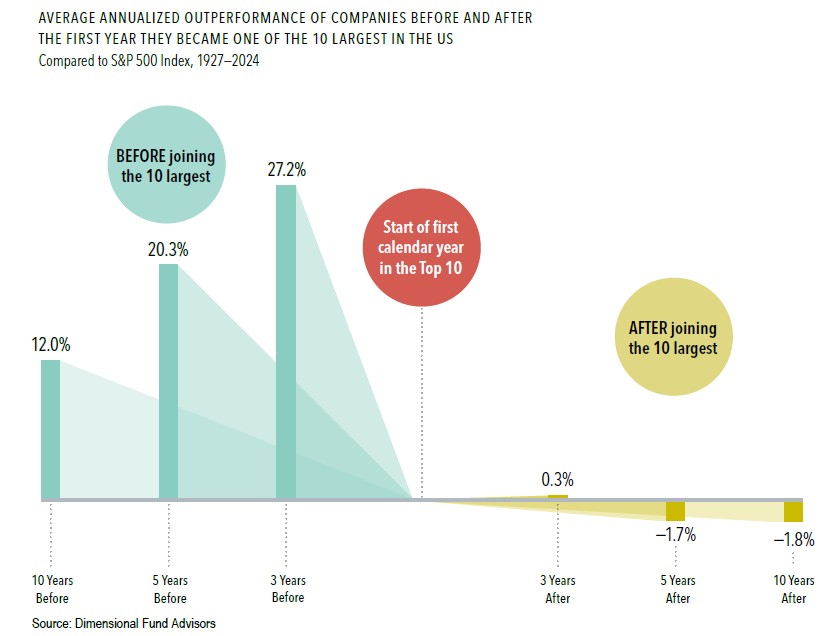

History also reminds us to be careful about chasing what’s hot. Dimensional, using data from CRSP, shows,7 that when companies first break into the list of the 10 largest U.S. stocks, it’s usually after a period of tremendous outperformance. But once they get there, the pattern often reverses. On average, those companies have lagged the broader market over the following three, five, and even ten years. The takeaway for us as investors is clear: by the time a company becomes one of the market’s biggest names, much of the good news may already be reflected in the price. That doesn’t mean these stocks won’t continue to play an important role in portfolios, but it does mean we shouldn’t expect the outsized returns of the past to automatically repeat.

That’s why our approach isn’t about avoiding these companies, but about keeping them in their proper place—held as part of a broadly diversified portfolio, rather than as the entire story of your future returns.

Pulling It All Together

AI is one of the most exciting forces shaping today’s economy, but the lesson for investors is bigger than any single technology or group of stocks. History shows us that the greatest beneficiaries of innovation are often the companies that learn how to apply it, not just the ones that build it. That’s why we’re already seeing value created across industries like farming, healthcare, and manufacturing, not only in Silicon Valley.

At the same time, it’s important to recognize how concentrated today’s market has become. A handful of AI-driven mega-caps now account for an unusually large share of the S&P 500, and their valuations stand well above long-term averages. Add to that the historical record: once companies rise into the market’s top 10, their future returns have often lagged the broader market.

The implication for investors is clear. These leading companies deserve a place in portfolios, but not the whole portfolio. By staying diversified, we give ourselves exposure to today’s AI leaders and to the many other firms across industries that will benefit from adopting the technology in the years to come. Diversification doesn’t mean settling for less, it means positioning for more of the opportunity, while reducing the risk of concentrating in only one part of the story.

Sources:

- Vanguard Advisor Insights, Joe Davis on AI, Debt, and the Future of Your Portfolio (August 2024). Link

- CropLife, More Farmers Are Adopting John Deere’s See & Spray — Here’s Why (2024). Link

- Siemens, AI-Based Quality Inspection for Modern Manufacturing (2024). Link

- UPS, UPS AI-Powered Route Optimization Enhances Efficiency and Service (2023).

- FedEx, FedEx Embraces AI to Transform Logistics and Customer Experience (2023).

- 6. J.P. Morgan Asset Management, Guide to the Markets. Link

- Dimensional Fund Advisors, Think Twice About Chasing the Biggest Stocks (Quick Take, 2024). Link

Disclosure:

This material is provided for informational purposes only and should not be construed as investment advice or a recommendation. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from TCI.